Dong is heading toward a future with overflowing cash and will stop divesting

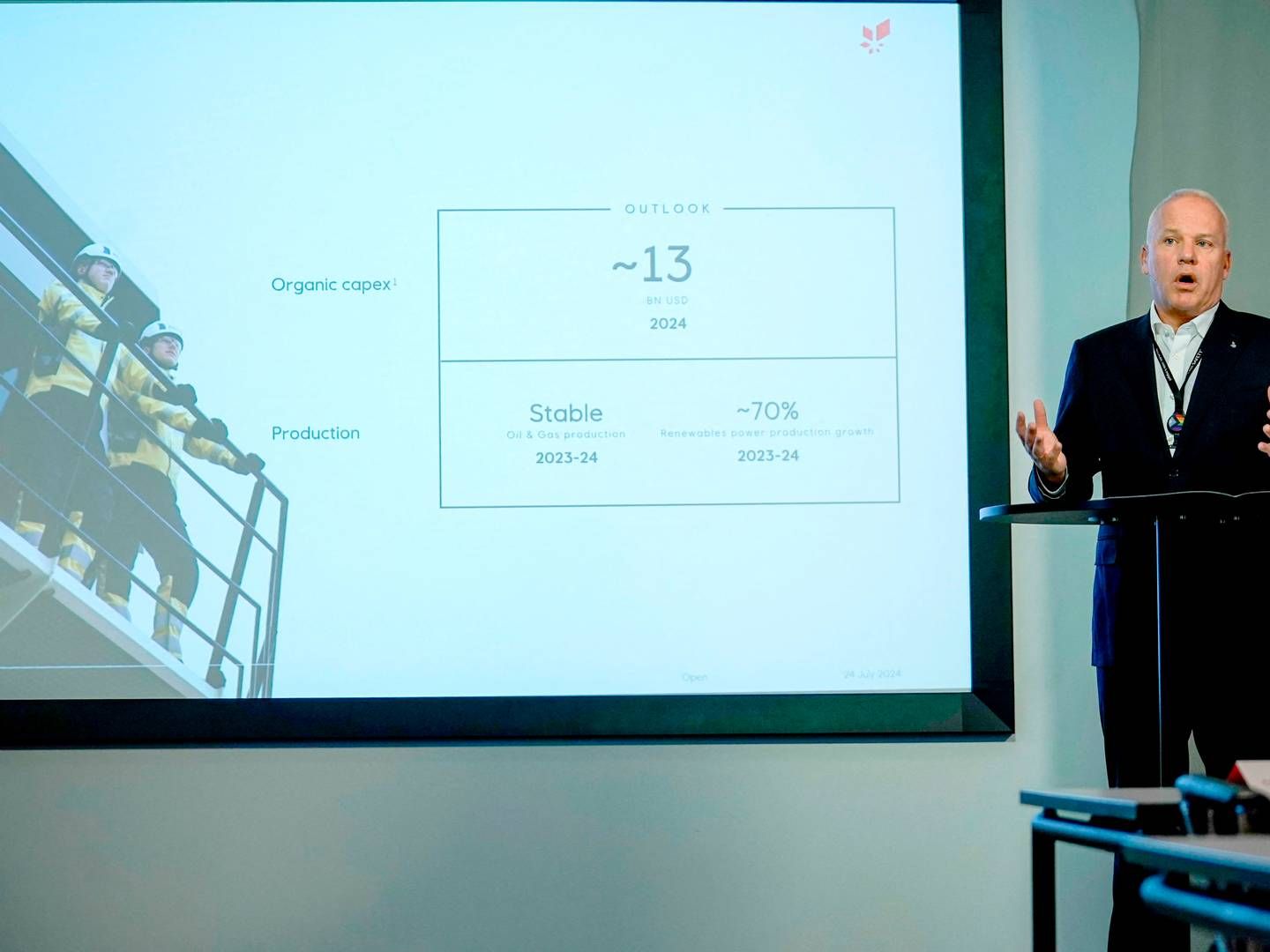

Good fortune seems to be smiling upon Dong Energy's offshore wind farms, with positive results once again adorning a financial report from Denmark's largest energy company. Meanwhile, this Thursday's Q2 report also represents a clear indication of change ahead.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Wind blows earnings through the roof at Dong

For subscribers

Dong in a strong offshore position

For subscribers

Dong paid millions in Hejre settlement

For subscribers