Hydrogen lobby CEO sees Denmark's chance to become "a kind of green Kuwait"

Asking Tejs Laustsen Jensen, chief executive of trade association Hydrogen Denmark, Germany's developing market for the elemental gas can only be underestimated.

That's why he is pleased that Danish and German network operators Energinet and Gasunie, respectively, outlined the future of gas exports from the Scandinavian country to its big southern neighbor.

"There will be a massive need for German green hydrogen import for transforming both Germany's industry and transport sector throughout the next ten years – we're talking about up demand for up to 100 TWh from green hydrogen in 2030. Someone must supply this, and here lies Denmark's opportunity to become a type of green Kuwait," he says in reference to the Middle Eastern country's massive petrochemical energy exports over the years.

"We have the potential to generate much more energy than we otherwise could from the North Sea by turning it into hydrogen and thereby making it more valuable for exporting to Germany," Jensen adds.

To succeed, adequate infrastructure is a precondition. In this regard, it's worth noting the conclusion of a preliminary feasibility study compiled by Energinet and Gasunie. The report shows that it would be viable set up a pipeline of 350-450 kilometers' length between the two nations in the direction of Europe's largest economy.

In terms of investment, it's also worth noting that such a connection would be able to repurpose around 50-60 percent of existing natural gas lines, taking the network operators' joint analysis at its word.

Competition initiated

There are, however, other ways to transmit H2, as noted by, for instance, Australia and Canada, both of which have already signed large hydrogen supply deals with Germany – and without needing to retrofit national infrastructure.

Even so, Jensen has no doubt that Denmark would be the more natural choice for an import-export deal with the big neighbor to the south.

"A far more tenable solution would be for us to stockpile our renewable energy output in Denmark, especially from the North Sea, and utilize it for powering European industry with Denmark's green energy. There's a strong business case in this. Indeed, someone might come along and say that this is no contribution to Denmark's 70-percent carbon emissions reduction goal, but doing so would allow us to help decarbonize German and European industry, thereby making a more significant holistic climate contribution," he says and adds:

"The climate doesn't care whether the source is in Sønderborg [Denmark] or Flensborg [Germany]. So, there's a huge economic potential, but I'm close to saying a moral obligation, that we as nation should embrace."

The scenario we are looking at in Denmark entails us transforming pipelines and other infrastructure to transmit hydrogen to Germany. Wouldn't it be easier for Germany to continue importing hydrogen from Australia and Canada via sea routes?

"No, I have a hard time seeing that. All other things being equal – and despite cheap hydroelectric in Canada and abundant sunlight in Australia, with both countries certainly having a bright future ahead in hydrogen – I think if we can produce cheap green power in the North Sea, convert it into hydrogen and then send it south into a European hydrogen infrastructure network, then based on transport costs per energy unit, it becomes a completely different calculus. Moreover, we can save energy in the form of ship fuel and all sorts of other things. It's a far more resilient setup," Jensen says.

German framework in place

The lobby's CEO is impressed with Germany's approach to the hydrogen market, not only on account of the country having already launched an H2 strategy last summer – something Denmark has yet to accomplish.

However, this is also because the questions is being addressed on the "chancellor level", just as hydrogen has its own section in Germany's economic recovery plan post-Covid-19.

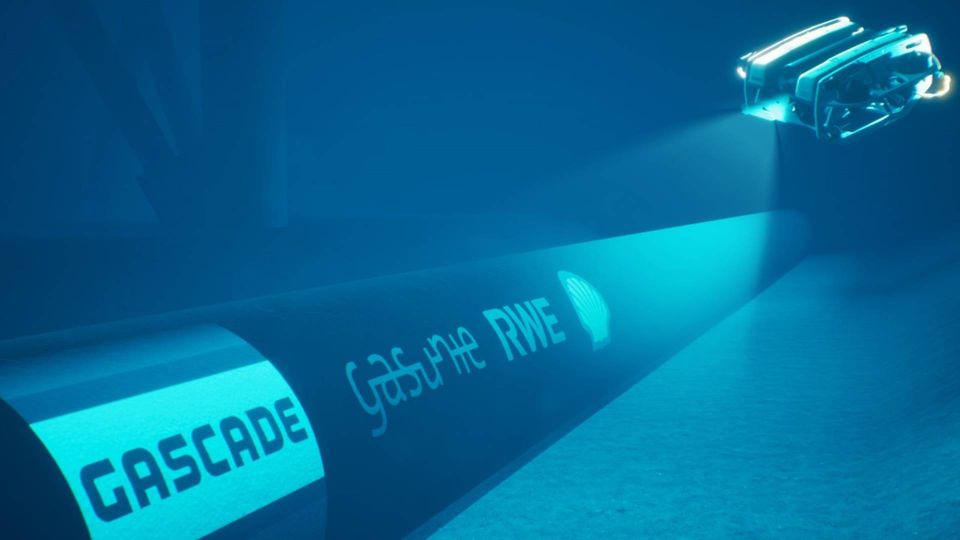

Rather, it's also in this light that developments such as the big Aqua Ductus hydrogen pipeline proposed last month by energy giants Shell and RWE should be seen. In any case, Jensen sees it as a clear expression of Germany's framework being well settled.

The pipeline is supposed to transmit 1 million tonnes of liquid hydrogen per year made via 10 GW of electrolysis capacity to convert offshore wind power from project Aqua Ventus, which has received support as a part of Germany's role in the EUR's Important Projects of Common European Interest (IPCEI) concerning H2.

Needs more money

News emerged in March about Denmark also becoming a part of the IPCEI program, involving the designation of domestic projects worth backing as flagship developments. Initially, DKK 77.6m (EUR 10.43m) were earmarked for that end. Jensen, however, says that sum is far from sufficient.

Why is it inadequate?

"It's not enough because this is about such large sums. We can see that France has reserved a one and half billion euros and Belgium what amounts to roughly DKK 2.5bn. So, these are indeed large sums, and we clearly need to be at that level. When speaking of hydrogen pipelines and large-scale production, energy is simply expensive," the CEO says.

Jensen notes that the Danish government has said that it will seek other avenues for project financiering. The CEO says he thinks a pool of approximately DKK 2bn would be a suitable contribution to the program.

"We need the strategy to be set"

In September, Denmark also became a part of the EU's hydrogen alliance, just as the government has stated that a national strategy for hydrogen and Power-to-X will be announced this year.

Hydrogen Denmark's CEO doesn't expect to see the strategy fall into place before after the summer holiday season. He underlines, though, that he doesn't see it as crucial whether it comes in August or September – it's more about content than anything else.

"We must be quick in getting started but not so in a way where haste makes waste. The most important thing is that we catch the balls already in play. That applies both to IPCEI but could possibly also extend to a bilateral partnership with Germany," Jensen says.

"But we need the strategy to come in 2021 – and for it to be ambitious," he adds.

English Edit: Daniel Frank Christensen

Equinor and Yara invest in British hydrogen fund

Hydro to raise funds for hydrogen efforts

Everfuel completes Scandinavian H2 plan with series of Swedish stations

Related articles

Equinor and Yara invest in British hydrogen fund

For subscribers

Hydro to raise funds for hydrogen efforts

For subscribers

.jpg&w=384&q=75)