Obscure EU bank postpones climate-friendly plan

BRUSSELS

Come November, it may be officially decided that gas companies as of 2020 cannot borrow money from the EU's major public bank, the European Investment Bank (EIB). The bank has itself proposed that it should be more climate-friendly, with initiatives such as making new rules for the type of energy projects it invests in.

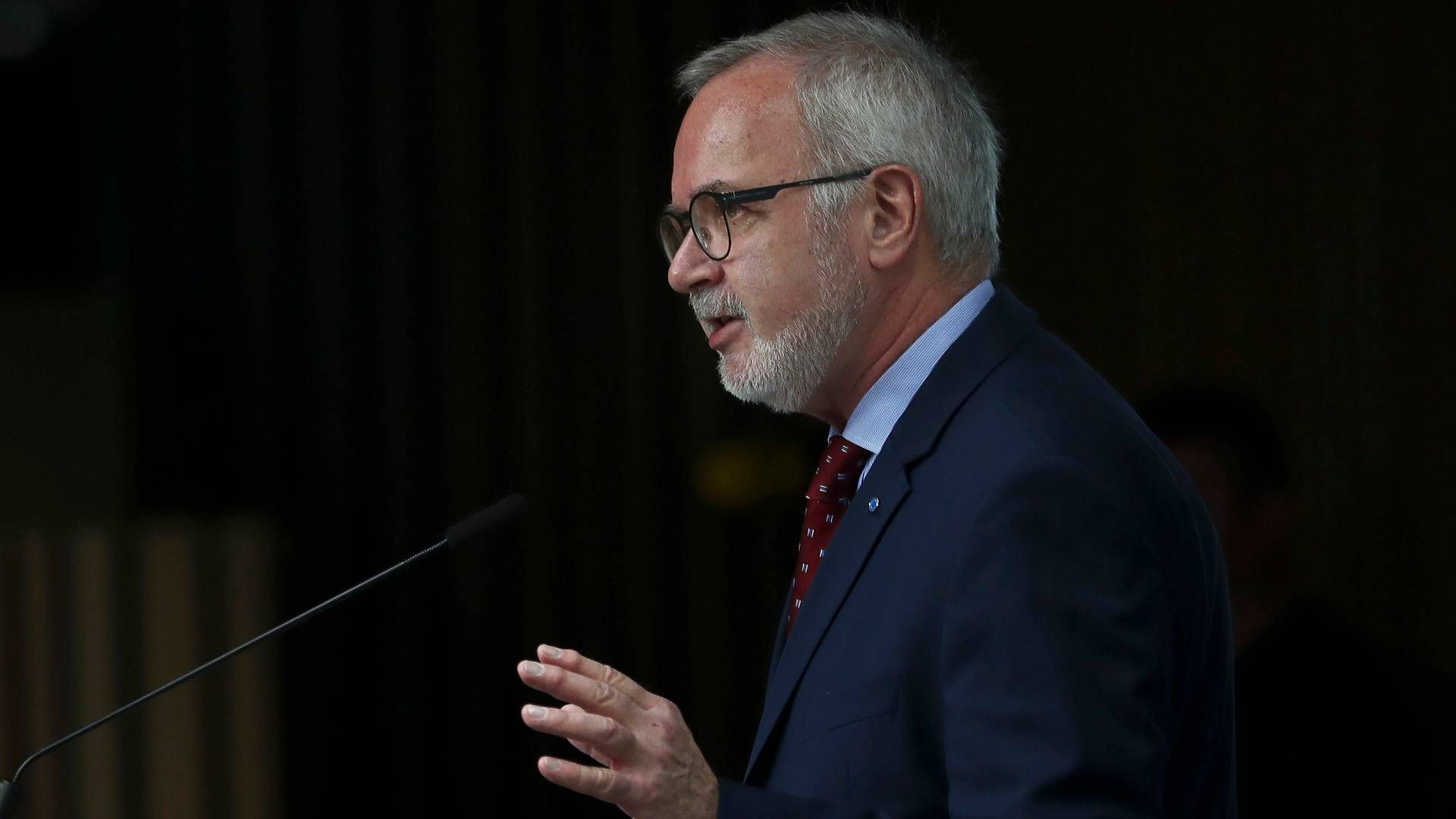

"With a very strong focus on energy efficiency, renewable energy, power grids as well as research and development, the EIB holds that the proposed policy on energy lending accords well with the EU's priorities and financing," said Werner Hoyer, president of the EIB, in a hearing at the European Parliament last week.

The EIB has made plans to phase out all fossil fuels in its loan portfolio, but it is up to the bank's owners – EU member states – to make the decision on whether to change the lending policy.

Gas hurdle

According to EnergyWatch's information, the reaction to the proposal has been relatively predictable. The countries normally leading climate change mitigation – for instance, the Netherlands, France and Denmark – have been positive.

Conversely, the countries most often pulling in the other direction have shown resistance. Initially, Germany took the pragmatic stance that it would like to make the lending policy greener, but that it would also have to listen to other members that oppose the move.

According to media Euractiv, the owners didn't manage to agree when they met to discuss the proposal on Tuesday. The media writes that, among others, Germany and the EU Commission were opposed, and that one major hurdle was the EIB's plans to completely drop funding gas projects.

However, the countries are to meet again in November, and by then the EIB's Vice President Andrew McDowell expects it's highly likely they will reach an agreement, according to Financial Times.

Bigger than JP Morgan

The EIB is relatively unknown to the public but is in fact a major player on the European loan market. Financial Times writes that the bank issues more bonds than JP Morgan, and with a loan portfolio exceeding EUR 450 billion, it's something of a giant on the market.

Due to its size in particular, the future make-up of the EIB's loan portfolio will have great significance for the funding of climate change mitigation, Birgitte Søgaard Holm, executive director of Investments & Savings at Finance Denmark, told EnergyWatch one month ago.

"There's no doubt that, when an EU institution as heavy-duty as the EIB wants to support and contribute to climate change mitigation, that's an inspiration to other players on the financial market. In the longer term as well, this will guide where investments in this area will take place," she wrote in an email.

English Edit: Jonas Sahl Jørgensen

Europe targets climate transformation under historic German boss

Norway's Sovereign Wealth Fund's inflows exceeded EUR 603 million in Q2

Developers see Danish RE subsidy cut as "retroactive intervention light"

.jpg&w=384&q=75)