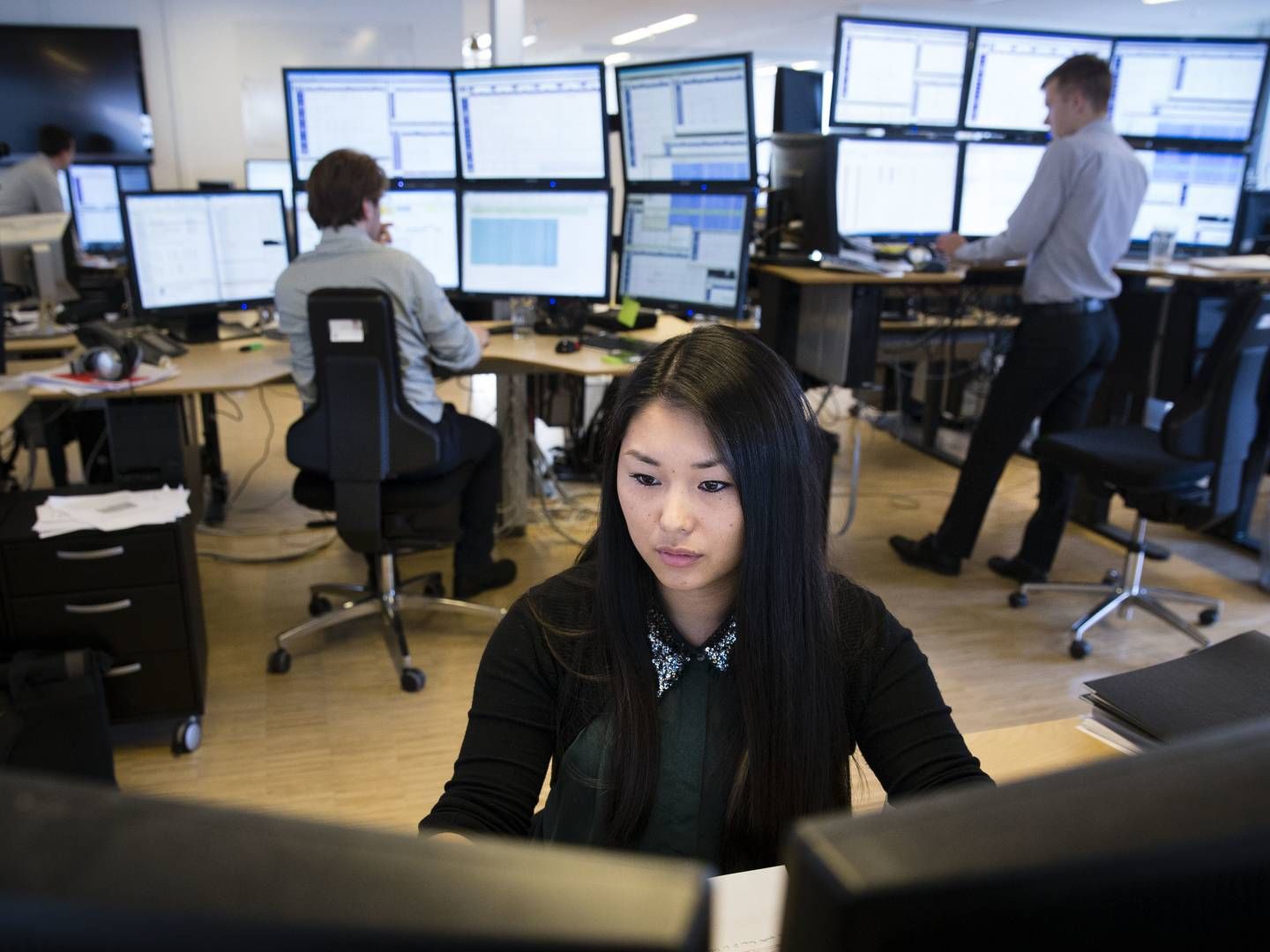

Equinor CEO happy with Danske Commodities

Equinor recently published its second-quarter report, showing operating earnings of USD 17.6bn, of course supported by extraordinarily high prices on oil and natural gas in a Europe amid an energy crisis.

Read the whole article

Get access for 14 days for free. No credit card is needed, and you will not be automatically signed up for a paid subscription after the free trial.

With your free trial you get:

Get full access for you and your coworkers

Start a free company trial todayRelated articles

Danske Commodities books skyrocketed 2021 revenue

For subscribers

.jpg&w=384&q=75)