Sweden tops European wind expansion

Swedish wind energy is having its heyday at the moment.

Swathes of contracts have been entered during the first half of 2019 and have added around 2.2 GW of wind capacity, which puts Sweden in the absolute global elite with respect to wind expansion. This year has already witnessed a tripling of 2018's 716 MW, when the Scandinavian country was ranked in eighth place for global onshore wind installations, omitting China.

Developers naturally see this as fortunate, but they don't expect the dramatic growth rate to keep pace.

"The growth we're seeing now is powerful on all parameters and naturally benefits us. We have a 20 percent market share, which has resulted in our domestic Swedish revenue having grown by 70 percent in the last four years," says Chief Executive Paul Stormoen of Swedish renewable energy developer OX2.

He underscores that 2019 has kickstarted the country's advance in wind, but the approximately 3 GW certain parties expect for full-year 2019 will probably not reoccur.

"This has also been a year driven by very large projects, and even though we expect this fine development to continue, it will most likely slow down in pace looking forward. 3 GW is a whole lot, so the volume could easily decline without implying market weakness," Stormoen says.

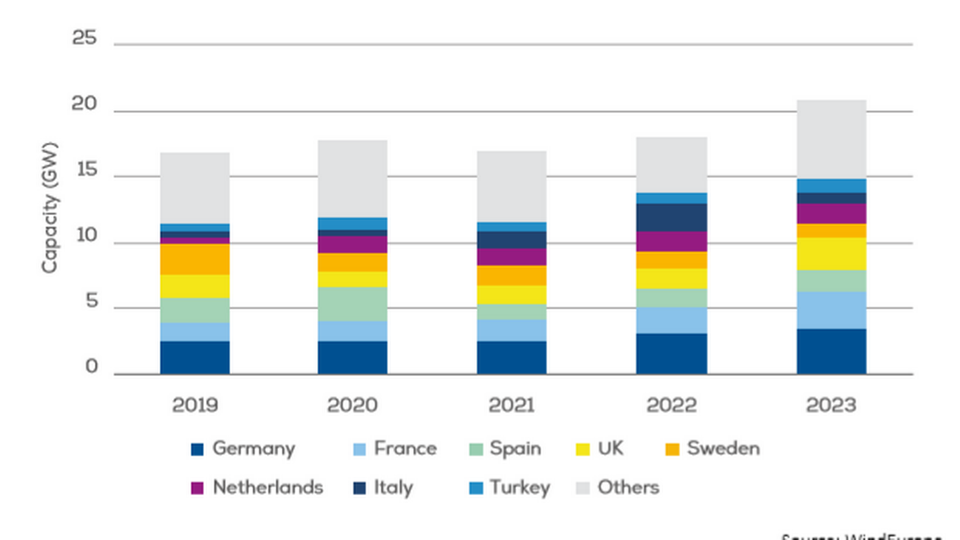

Wind Europe's latest report, Outlook to 2023, confirms this picture and ranks Sweden along with Germany as Europe's largest wind market. However, it also indicates that Sweden – dissimilarly to countries like France, the Netherlands and the UK – is peaking at the moment and is expected to slow down ahead to 2023.

According to WindEurope, Sweden will have doubled its wind capacity from 7.4 to 14.9 GW in 2023. But roughly one third of the expansion will take place in 2019 and then decline over the following four years.

"There's a small shortage of development projects, which I think could be a defect. This means that we will see some holes in the expansion from time to time. But I do believe we can expect the expansion to continue at more or less the same pace up to 2022, but it will also be more volatile than its has been thus far," Johansson says.

Such volatility can already be read in the entered contracts, which peaked in 2017 after sliding between 2014 and 2016.

Certificate spree

In the spring of 2017, the Swedish government extended the national certification ordinance, which has functioned as a subsidy scheme since 2012, and set a target for an additional 18 TWh in RE generation ahead to 2030.

In the period leading up to this, the certification market collapsed, and the new injection led to the hitherto unseen construction boom currently going on Sweden.

Already two years after adding the new certificates, the goal of 18 TWh is already achieved far ahead of the 2030 deadline. From January to September, the certificate price depreciated to roughly one quarter and is currently at SEK 54 (EUR 5.02) – the lowest price to date, and Swedish energy trader Svensk Kraftmäkling projects that the price will continue to decline.

Developers hope this development will lead to the certification system's demise.

"It is advantageous for wind power in Norway and Sweden to not be dependent on subsidies. It reduces risk for investors, which is, of course, positive. However, it could end up becoming a problem for older facilities. They were under the impression that they would have a secure income for 15 years and that is now instead being used for new wind energy, which doesn't need it. That doesn't make any sense and is illogical," says Johansson.

Stormoe would also like the see the certificate system be terminated.

"If the system doesn't shut down, it will soon hit zero. That's obvious. The general assessment at the moment is that there is more value to fetch, but new investments don't take account of the certificates," says OX2's CEO.

The question is then how projects will be financed after the certificate scheme expires. Power purchase agreements are often highlighted as the replacement model for public aid.

"It's exciting to see that there is such a large appetite for the risk that PPA's by their nature pose to investors, and it's also interesting to see that there are investors who are prepared to enter shorter contract durations. The tendency is clear, but we'll have to follow development. PPAs are important, no doubt about that. Are they the only path the unsubsidized wind? That's where I'm skeptical," Johansson says.

Smaller future projects

Beyond this race to the finish line in the attempt to wring the certificate scheme completely dry, the decommissioning of nuclear plants has also been a contributing factor for Sweden's wind expansion.

The pace picking up again in 2019 is attributable to project size.

"We still expect major activity, but we also expect this activity to be carried by many smaller projects, which means that the volume will also decrease, but this shouldn't be seen as a lack of confidence from investors, offtakers or political systems," Stormoe says and continues:

"We have seen a series of megaprojects that matured last year and which are being built right now, for instance, Markbygden at 1.1 GW. So, the figures we're seeing at the moment are distorted compared to the overall picture. Even though growth in volume will fall over the next few years, this won't mean much for us. We expect to continue our growth at least until 2030."

English Edit: Daniel Frank Christensen

Military downs Vattenfall wind project

Norway hit by ketchup effect, politicians bungled expansion plans

Axpo signs PPA with Finnish twins

.jpg&w=384&q=75)