Better Energy plans 7GW in Danish solar capacity

If a person is interested in knowing how a company fares, reading through its annual financial statement is, of course, a quite fitting place to start. Normally, though, one must have a proper look at the figures before finding out whether things are moving forward or retreating.

This, however, is not necessarily true in the case of Better Energy. Printed in the full-color spectrum upon luxurious, heavy paper and published in a hardback copy, the 2018 annual statement serves as a pretty decent indication that all is well with the Danish project developer. And the report's 162 pages might seem to support the notion that no attempt was made to sweep anything under the rug.

Peering deeper into the figures also supports such an inkling. In only three years, both revenue and profit have grown by an approximate factor of 17, with sales totaling DKK 424 million (EUR 58.08 million) and a net result of DKK 65 million – figures that could appear massive considering the company's six years in existence with a relatively limited commissioned portfolio of 229 MWp, but also figures that harmonize well with Better Energy's outlook for the future.

"We expect to install 7 GW of solar power in Denmark within the coming 6-8 years," states Better Energy Chief Executive Rasmus Lildholdt Kjær.

For perspective, that's more than Denmark's current combined capacity build-out for onshore and offshore wind and precisely seven fold the country's hitherto solar PV capacity ranging from residential rooftops to field-sized farms.

"We'll install 100 MW this year, but our present portfolio in Denmark contains 3 GW, and our expansion rate will accelerate much faster from 2021."

Efficiency replaces price reduction

At an earlier point in time, this kind of ambition would have made Danish politicians squirm. When company Solenergi Danmark planned to build 5 GW attached to the country's 60-40 public aid scheme, the subsidy was promptly shut down by Parliament.

The scheme painted a rather telling picture of the development of solar power in the country. For many years, the support pool lay untouched, as no one at the time thought it economically viable to build a solar farm with a 20-year subsidy for an average price of DKK 0.50 per kWh. Now such a level appears unrealistically high.

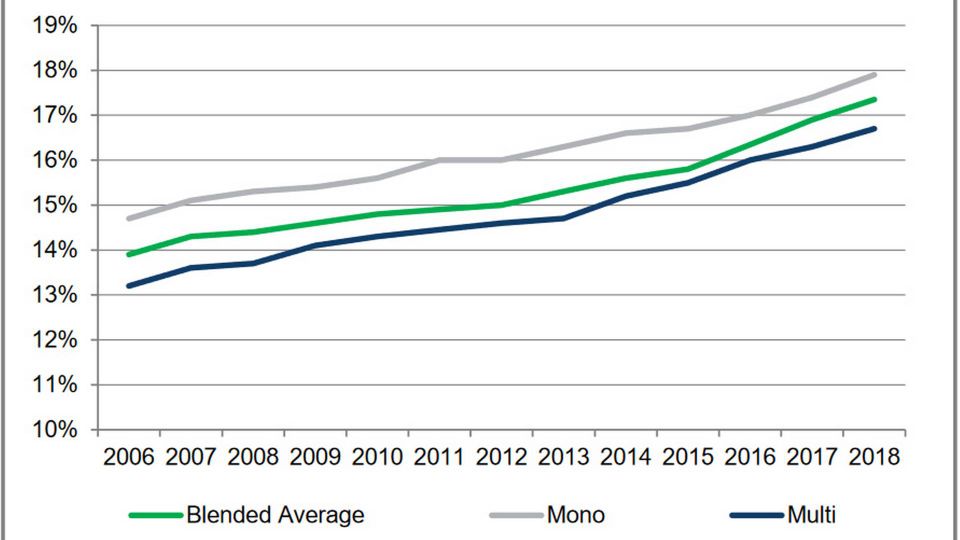

Lildholdt Kjær, however, doesn't expect that this trend of recent years, with sustained, double-digit price reductions, will continue. Rather, he reckons something else will enable the massive expansion.

"Prices may very well fall – but not to the same degree. Instead, price reductions on raw materials are in the process of being replaced by solar panels becoming increasingly more efficient," assesses the CEO, who also offers a bid for explaining how Better Energy will play a central role in the expansion.

"We're going from a project-based approach to investing in scale, which has a cost-cutting effect. This allows us to install the facilities at prices 15-20 percent lower than others are capable of achieving in Denmark."

Factoring for cannibalism

This price decline doesn't apply only to the facilities. An inherent problem with solar and wind power is that when generation is at its highest, when the sun shines and the wind blows, added supply decreases the electricity's exchange value.

Such price cannibalization is, naturally, more pronounced in correlation to how much capacity of a given technology is online. The number of output hours when the price turns decidedly negative due to Denmark's wind capacity is on the rise. Even if solar panel efficiency is lower, implementing 7 GW of solar will also have the same effect," Lildholdt Kjær concedes and adds:

"Yes, it indeed will. We expect nothing else."

"We will add massive volumes of solar energy, and by doing so we will also cause the price of power to decline at certain points in the day. Every day and every year, the price of our green energy decreases, and when we have 7 GW installed in a few years, we will, of course, have placed this into the economic context in which it will operate. Furthermore, in the future, electricity will also have many more applications."

PPA pool

Before the market within, for instance, power-to-X starts to create customers beyond standard ratepayers, more conventional customers will be needed – only on a much larger scale individual consumers.

The developer has now already entered power purchase agreement with both Google and Danish fashion group Bestseller and are aimed at realizing the country's first unsubsidized solar farm. The financial model, often thought of as the next big thing after public aid, holds much more potential.

"It tires me when people say PPAs will be arriving shortly. They're here right now, as long as the projects are viable. We experience an enormous willingness among companies," Lildholdt Kjær says.

He acknowledges, though, that there are a limited number of businesses in Denmark in the same league as Google, or Bestseller for that matter. But this doesn't mean that the functionality of the PPA model fails just because the big companies have their power needs covered. However, it will require project owners to think new and develop models in which small and medium-sized operations can enter joint PPAs.

"The need helps in making it easier. This must happen by pooling companies together to achieve a critical mass, but this doesn't mean that all parties have to commit themselves to buying the same volumes or have the same durations. If that part can't work out right now, it'll certainly be able to do so in the near future."

No unnecessary resistance

The projects Better Energy is planning don't need to be completely identical. Rather, the facilities could be rated at 25-250 MW, dependent on possibilities relating to both the grid and surface area of the respective areas.

In terms of space, 7 GW sounds like a whole lot, regardless of placement. Opposition to development projects is no longer the sole domain of wind turbines, and Better Energy has also experienced as much in connection with a few of its prior solar projects. However, these major plans will take up less space that one might imagine, the CEO points out and adds that there is a great deal of suitable land for solar farms.

"We really have to be careful to not create a unnecessary opposition to the green energy transition. 7 GW would take up 7,000 hectares; Denmark has around 1.5 million hectares designated as areas with special importance for ground water and where intensive agriculture is unsuitable. Such areas would be perfect of solar farms," he says.

Electricity seller

The advantage of such areas is not limited to these not occupying and excluding land from other applications. At the same time and for the same reason – this land is hardly the costliest in the country. Along with other elements such as industrial access, economies of scale and PPAs, it should be possible to stitch together a business plan that doesn't fray at the seams.

However, not all of these factors are completely crucial as such – not even PPAs are necessary for securing financing in an unsubsidized market. When project developers at some point find even more stable footing, Better Energy doesn't reject the notion of taking the full risk and building a a project and selling the power on the spot market to whatever the going rate might be.

"That's clearly something we're planning on doing in 3-5 years in step with us being able to finance the projects ourselves. It's not something we'll have to do, but it'll be natural for us, just as it might make in some situations to sell parts or the entirety of a given project. It will depend on risk assessment for the individual project," the CEO says.

Polish potential

Better Energy will surely end up spending a lot of money in the coming years to realize its ambitions. This won't stop at 7 GW in Denmark; the capacity target in some of the company's other key market is set even higher. Better Energy plans to build 10 GW in Sweden and 20 GW in Poland, which is also forecast to become one of Europe's largest growth markets in the coming decade within solar PV.

"Poland has the potential for 40 GW of solar. Whether we end up building 40, 20 or less than that, time will tell. In the same sense, it would also be fine for us if we only install 4 GW in Denmark and then some others come and build the rest. But we will aim for bigger projects, enter markets at earlier stages and drive development," Lildholdt Kjær says.

English Edit: Daniel Frank Christensen

"Wind has struggled to be free of subsidies for 40 years, and now – at this moment – it's happening"

Related articles

Better Energy expands in Poland

For subscribers

China says it agreed with US to roll back tariffs in phases

For subscribers

.jpg&w=384&q=75)