Statkraft didn't foresee record-low power price

Norway's spring of 2020 was dominated by the dramatic oil price plunge, which in a few weeks had fallen from around USD 60 per barrel to just under USD 20.

Around the same time something else also happened. It began to snow, and the chilly precipitation finally fell upon the power company's bottom line today – a true blizzard.

The large volumes of snow were followed by a dramatic temperature increase in June that sent electricity rates historically southward, and Statkraft's bottom line followed suit, which, mainly due to positive financial results of NOK 2.3 billion (EUR 220 million) stemming from a restrengthened krona, ended with a modest result of NOK 491 million. That's NOK 1.6 billion less than the same period last year.

"It wasn't something we knew of nor anticipated ahead of time. However, as the large snowfall began this spring, we also started to acknowledge that we could end up with very low power prices during the summer. This is a very special situation," Statkraft Chief Executive Christian Rynning-Tønnesen tells EnergyWatch.

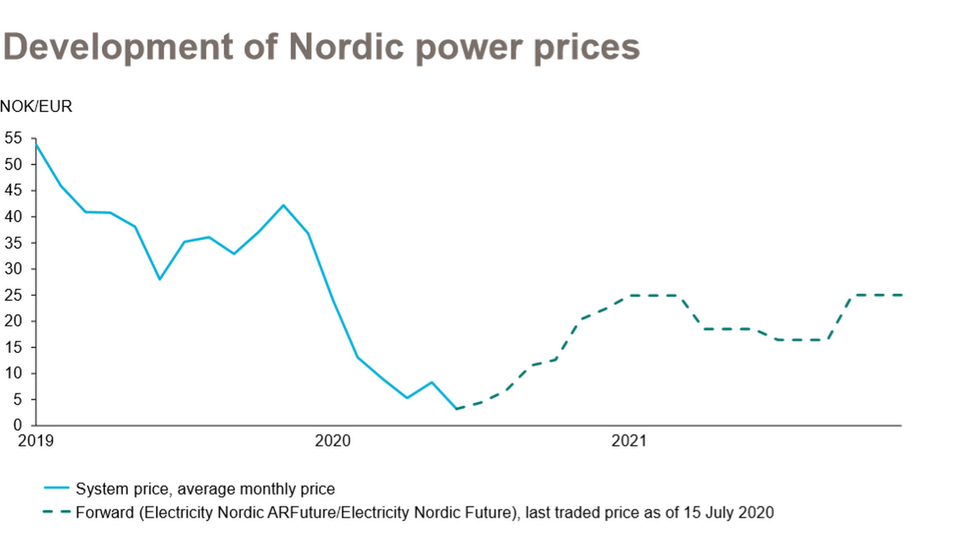

In hard figures, this abnormal situation entailed an average electricity fare of EUR 5.6 per MWh, down 84 percent against last year.

"We see these variations from time to time, but it's a rare occurrence we had this year. Looking back on the last few years, this appears very unusual;" the CEO says.

Price hedging saved the day

As the big volumes of snow began to melt, Norwegian power generators started to empty their hydroelectric reservoirs, which in almost each case were filled to the top after a wet winter.

This foreshadowed May's low tariffs, which were realized when the large snow volumes thawed and flowed down from the high fells in June and sent Norwegian prices into unprecedented negative territory.

From this perspective, the utility's CEO consoles himself that Statkraft at least had some sort of income.

"We have physical contracts for around 20 TWh of our combined global generation, which comprises roughly a third of our production. Moreover, we have entered financial hedging contracts that have stabilized our cash flows, for which we're noting changes each quarter. So, this doesn't stabilize the result but rather the cash flows. We still want to have a large part of our generation secured through physical contracts. The proportion can decrease a bit, but our target remains to have at least 25 percent insured."

Murphy's export cables

As a result of Murphy's Law, something else also occurred while the snow began to fall as an auspice of lower electricity rates and filled reservoirs: Norway's export cables began to malfunction en masse.

There were problems with the Dutch connector, while the Skagerak line to Denmark broke down and reduced transmission capacity of 1.7 GW to a meager 330 MW. The massive 2.145 GW cable to Sweden was severed when an anchored ship began to drift and ripped three of nine cables apart. When these were repaired, a larger Swedish renovation project began that has taken the power line almost completely out of action.

As the idiom goes, misfortunes rarely come alone, and the damaged export cables were a pivotal factor in the snow proving fatal for the Norwegian power price, as this created a clot in Southern Norway, with surplus electricity with no where to go.

Private power cable

In the course of next year, two new Norwegian transnational interconnectors will come online when transmission system operator Statnett completes its Nordlink line to Germany and the North Sea Link to the UK, each able to carry 1.4 GW.

The privately financed interconnector Northconnect would allow the transit of a further 1.4 GW to the UK, which power companies Lyse, Adger Energi HafslundE-Co and Vattenfall were backing. Back in March, though, Norwegian Parliament repealed Northconnect's permit after popular opposition, thereby rendering its completion uncertain.

This resistance was twofold and mainly consisted of the claim that such cables normally lead to higher power prices, while other opponents feared the transmission line would be used in an argument for building more wind farms.

This displeases Statkraft. Despite not holding a stake in the cable project, one more vent in the form of an interconnector would reduce the risk of a situation like the present price issue from happening again.

So, how can this be explained to a population that first and foremost insists on seeing new export cables as something that leads to a larger power bill?

"Several analyses have shown that an export cable like Northconnect would lead to a weak price increase of NOK 1-3 per kWh. But in a situation opposite to what we have right now, with very little snow falling, then such cables would also serve as a buffer against high electricity rates. We think it's an advantage for everyone to have power prices that are more stable and don't fluctuate between near zero, as we're seeing now, and an extremely high level during dry times."

Damp lesson

On top of a quarter during which the power price fell to an almost non-existent level, Rynning-Tønnesen has learned to appreciate the value of wearing belts and braces. A series of factors have namely shielded the utility from the grim effects of a domestic electricity market suddenly without a floor.

"We have a large proportion of physical contracts that allow us to maintain an income despite extremely low power prices. Furthermore, we have positive currency effects, because the Norwegian krona has regained some strength, and we had, unusually, a positive tax income during the quarter. The latter is because we have a series of contracts with built-in derivatives tied to oil, coal, gas and metal prices, which declined in the quarter. This means that we have an unrealized decrease in future income," the CEO says.

He repeatedly underscores that it's theoretically possible the power prices could implode again in the same way. However, it's also improbable, the CEO says and takes solace of the situation in that, when something hits rock bottom, things can only get better. And that's just what Statkraft's long-term prognoses indicate.

"Right now we expect the price to gradually increase to EUR 20 per MWh in the fourth quarter and subsequently normalize in 2021 and 2022. But there's just so much uncertainty associated to this," Rynning-Tønnesen says, adding:

"If we had an adequately strong power network, then this situation wouldn't have been a problem, because the electricity would simply have been sold further down in Europe. The combination our current power grid, bottlenecks and the heavy snowfall was a recipe for low power prices. Grid reinforcements are high on our wish list. In principal, we support anything that bolsters the power grid and improves international connections. It's unbelievably important for the whole of society," Rynning-Tønnesen says.

English Edit: Daniel Frank Christensen

Statkraft alters its green strategy

Cash pours out of Statkraft after power price collapse

Related articles

Statkraft alters its green strategy

For subscribers

Cash pours out of Statkraft after power price collapse

For subscribers

.jpg&w=384&q=75)