European Energy reboots debt at lower cost with record-setting green bond

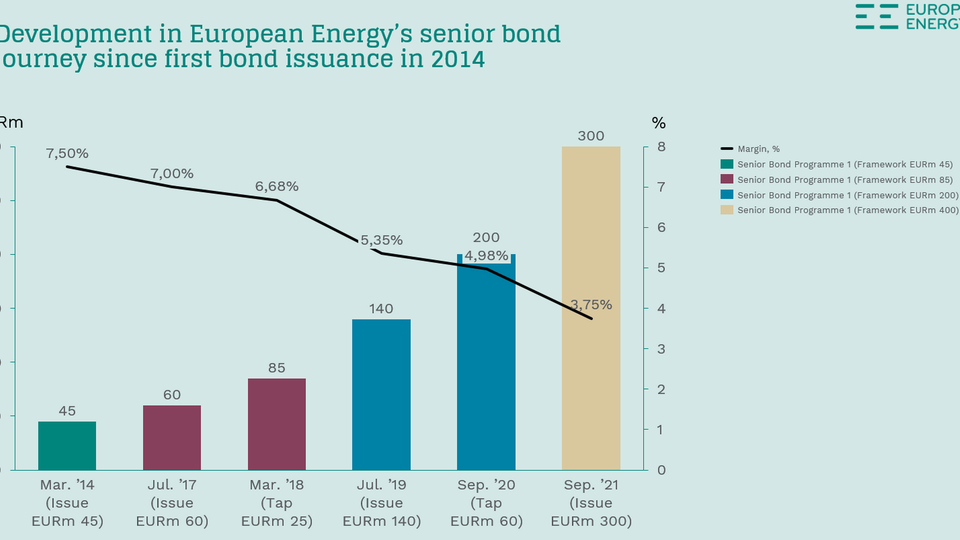

Danish project developer and power producer European Energy sets a domestic record for corporate bonds issuances, this one nominally totaling EUR 300m with maturity set for 2025.

Most of the capital raised will be used to pay off the preceding bond debt of EUR 200m issued last year but at an interest rate of 4.95 percent against 3.75 percent for the latest issuance.

By raising a further EUR 100m, European Energy expands its financial elbow room to enable investments in largest solar and wind projects.

Meanwhile, with a concurrent credit facility of EUR 45m provided by Danske Bank, Nordea and DNB – also the three banks appointed as "joint bookrunners" to handle issuing the new bond – the developer gains even more leeway on its bank account and thereby technically strengthens its economic muscles with EUR 145m.

"As front-runners in combating climate change, we have been scaling up our organization to be able to grasp the growing renewable energy project opportunities. This means that we have quadrupled the construction of green energy capacity to more than 1.1 GW since last year," writes European Energy Chief Executive Knud Erik Andersen in a media release.

"With our new financing structure, we will be able to further accelerate the growth of the company and keep up with the increasing demand for green projects," he adds.

European Energy quadrupled project construction in H1

European Energy secures financing for Lithuania projects

Related articles

European Energy quadrupled project construction in H1

For subscribers

European Energy secures financing for Lithuania projects

For subscribers

.jpg&w=384&q=75)