Welcon doubles production capacity

Looking forward, 200,000 tonnes of steel will be welded into wind turbine towers along with another 40,000 tonnes of the structural metal formed into floating wind foundations at Welcon's factory in the southwestern Danish town of Give.

To accomplish as much, Welcon will use four new workshops for prepping plate steel and welding, one new setup for surface treatments as well as a larger storage warehouse.

This scaling is taking place now so Welcon can keep pace with green policy ambitions, both domestically and generally in Europe, says Welcon Managing Director Jens Pedersen to EnergyWatch:

"Installation of more wind turbines requires production of more towers. We would like to supply towers for the new big wind turbines appearing on the market."

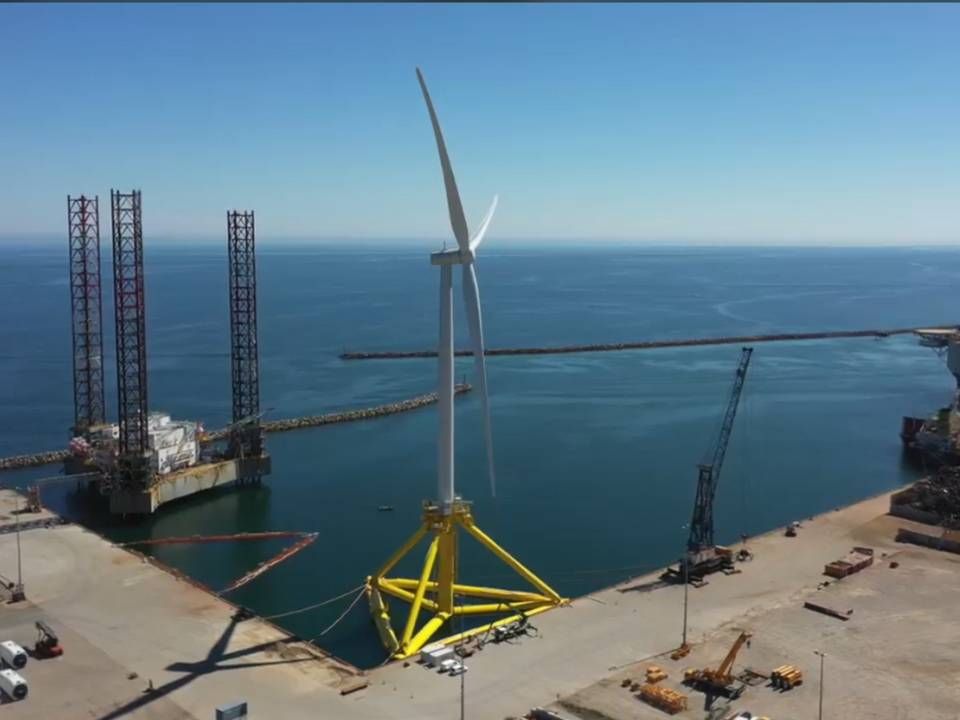

At the same time, Welcon will manage industrial manufacturing of steel foundations for renewables company Stiesdal's floating foundations starting from 2023, the year Welcon expects to complete the expansion. The company has already supplied foundations for the first Tetraspar platforms now floating off the coast of Norway.

Pedersen declines to reveal the identity of offtakers for the doubled tower production.

Import tariffs on Chinese towers without direct effect

Last fiscal year, Welcon booked record revenue of DKK 740m (EUR 99.4m), while profit slid a bit to DKK 2.1m, leaving the tower maker with a thin margin of 0.27 percent due to a highly competitive market, the Covid-19 pandemic as well as squeezed prices.

How will expanding help Welcon in this situation?

"We gain some advantages from the larger scale and volume, and we've also become more knowledgeable about how we can optimize production and thereby build it into the new facilities," the managing director says.

Some of the competition, according to numerous supplier, stems from imported Chinese steel towers, which the EU Commission has now classified as illegal price dumping and imposed punitive tariffs accordingly.

Even though Welcon has advocated slapping import levies on towers from China, Pedersen will not go so far as to say that the commission's measure will have an direct effect on the company.

"We have fought to have import tariffs imposed on Chinese towers because evidence shows that China subsidizes steel production and thereby also indirectly supports tower manufacturing," he says:

"We are, of course, pleased that the EU has handled this, but I'm not sure if it will have a direct effect on us – more on the market. Wind turbine towers are sourced from many countries, not only China. However, it helps nothing that policymakers say they want the green transition if we in the industry cannot deliver."

Thus far, Welcon has succeeded in supplying half of all European offshore wind towers, attaining after the expansion the continent's biggest factory producing the increasingly large steel components.

EU imposes punitive tariffs on Chinese wind turbine towers

Stiesdal's floating solution operational

Welcon's record revenue shaves paper-thin profit margin

Related articles

Stiesdal's floating solution operational

For subscribers

Welcon's record revenue shaves paper-thin profit margin

For subscribers

.jpg&w=384&q=75)