Tesla loses US tax credit on certain models

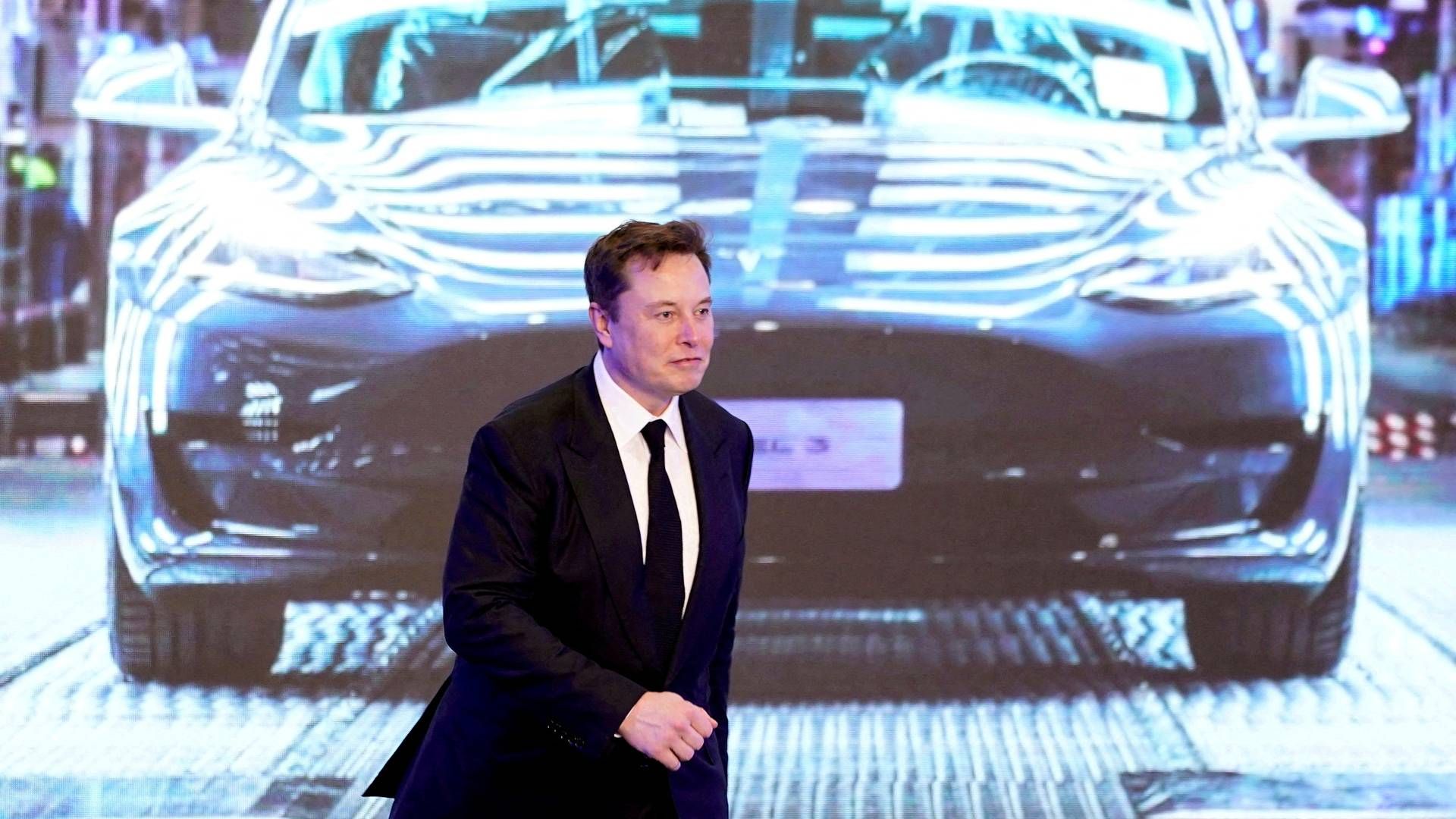

Certain Tesla models fail to qualify for coming tax credits to be introduced as a part of the federal US government’s Inflation Reduction Act (IRA).

Such models include select versions of the carmaker’s most popular offering, the Model Y.

Elsewhere in automotive, Hyundai Motor is more fortunate in that regard, whereby the company’s customers will be able to deduct USD 7,500 from taxes otherwise due on car purchases.

Most Model Y configurations are not heavy enough to qualify as a sports utility vehicle (SUV), and at a starting price of USD 65,990, the model is disqualified for the tax credit due to exceeding the price limitation set by the act.

”Messed up!” comments Musk on Twitter.

Larger versions of of the Model Y are eligible for the tax write-off, however.

Rivian underperformed like Tesla in Q4 sales

80% of Norway’s new car sales in 2022 were electrics

Tesla shareholders fed up with Musk’s preoccupation with Twitter

.jpg&w=384&q=75)