Ineos explores CO2 storage in old oil wells

Spent oil processing rigs have no value for society and require clean-up efforts after being decommissioned and disassembled. For Denmark, according to consultancy firms Douglas-Westwood and Deloitte, these costs average at EUR 130 million per year. In other words, similar decommissioned rigs are nothing but a burden from a socio-economic perspective.

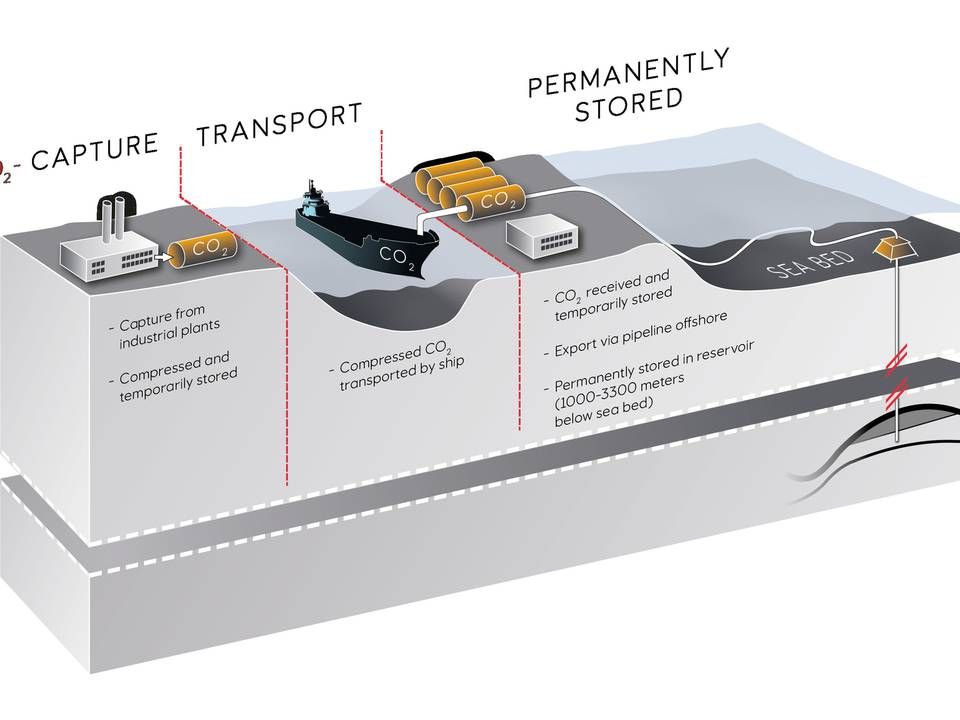

However, this might not always be the case in the future. Rather, such installations could turn into an instrument of climate change mitigation. Right now, UK-based chemical and fossil fuel multinational Ineos is exploring possibilities for storing CO2 under the Danish North Sea – a technology called carbon capture and sequestration (CCS).

"The Danish Council on Climate Change indicates that carbon capture could already begin in 2025 and that storage could have a real influence in 2030. That's also our target: We're working from the assumption that it will be possible to store CO2 from the second half of the '20s," says Ineos Denmark Developing Assets Manager Johan Byskov Svendsen.

No other company operating in the country has made it as far with a CCS project as Ineos.

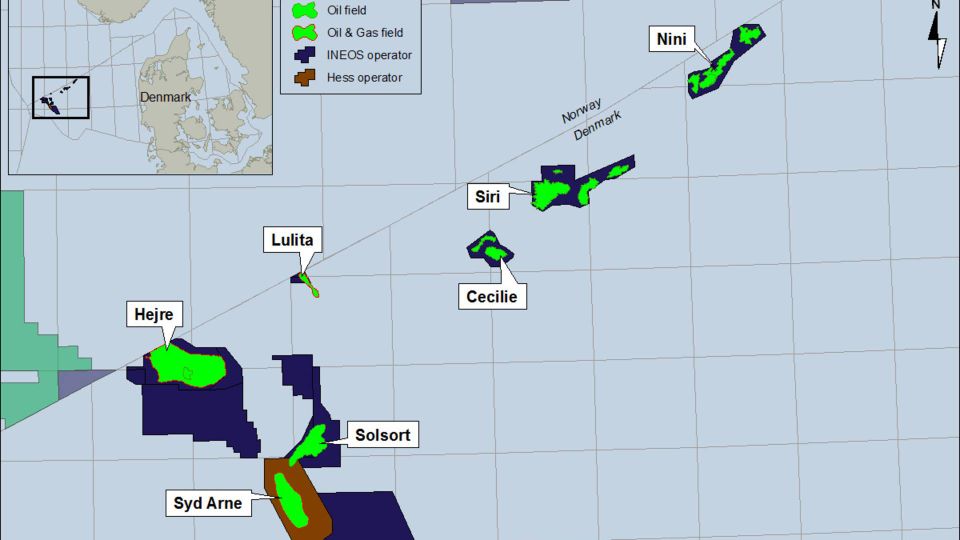

The oil company is currently investigating the reservoirs of four adjacent oil fields Nini, Nini East, Cecilie and Siri, all of which have uniform underground geologies.

This project has, until now, not been publicly known but holds big potential as a contribution to Denmark's climate ambitions.

The project will first require that Ineos provide evidence of the area's suitability, and the company hopes to conduct pilot tests from 2022. The group aims for a full-scale demonstration facility to be established by around 2026 and by then store at least 500,000 metric tons of carbon dioxide per year.

At the moment, Ineos is looking into the Nini field for the purpose, but Cecilie is also an option, Svendsen says.

Carbon taxes will get things moving

In the Danish Council on Climate Change's (DCCC) latest report, which proposed methods for Denmark to use in achieving its 70-percent emissions reduction target by 2030, the group recommends that CCS technologies comprise approximately 15-20 percent of the combined goal.

This 15-20 percent could, in principle, be solely sourced from Ineos' endeavor, if everything goes according to plan under accommodating conditions, shows a document sent by the Technical University of Denmark (DTU) to the Climate, Energy and Utilities Committee.

DCCC Council Member and DTU Professor of Energy Economics Poul Erik Morthorst says the pace of CCS progress is too slow:

"The sooner we get such demonstration facility's set up the better. Looking at the large emitters such as Aalborg Portland [domestic cement producer, -ed.], it's important to begin reducing some of that CO2 immediately," he says.

The DCCC has never attributed so much importance to CCS as now. How has this technology suddenly become so interesting for the council?

"It was triggered by the high carbon tax that we propose. Solely through implementing tighter measures on things we're already doing, we propose a CO2 tax of DKK 1,000 [EUR 134 million, -ed.]," the professor says and continues:

"And looking at the development trajectory in our recommendations about adding new transitional elements, we're indicating a CO2 tax of DKK 1,500."

Such a levy would make CCS much more attractive than it is today.

But it's also completely necessary.

Svendsen acknowledges that the project cannot be accomplished without public support.

"CCS should be seen like wind turbines 40 years ago. They are now a major success but for many years were dependent on subsidy. It will be the same with CCS. It can solve the need as indicated by the council, but it's no business case. Storing CO2 isn't lucrative. And we lack a regulatory setup and strategy on the matter," he says.

As EnergyWatch has previously reported, CCS licenses are currently unavailable in Denmark. However, the country's parliament plans to revisit the question later this year – and the outcome of the discussions will be decisive for Ineos.

"All our pricing assumptions and viability assessments are based regulatory barriers not being in place. If we are going to move forward with the project, those will need to be removed," Svendsen says.

Established data sets

Ineos has a close partnership with Geus, an independent institution under the Danish ministry of Climate, Energy & Utilities.

Geus assesses that there's potential to store no less than 22 billion metric tons of CO2 equivalent (Co2e) under the Danish North Sea.

This mainly applies to sandstone reservoirs that are particularly well suited for storing carbon dioxide. Denmark has plenty of those, for instance, under the North Sea, where Ineos' four platforms are situated close to each other.

Ineos will first need to analyze the sandstone reservoirs, not least to ensure the presence of a sealed clay layer atop the reservoir that could contain the CO2 after being pumped underground.

If the concept proves viable and the framework conditions are adjusted, Svendsen deems that old oil fields offer an advantage compared to other CCS projects:

"Oil fields have the advantage that large data volumes have been collected throughout the field's lifecycle, meaning that there's an unbelievable amount of knowledge about the underground," he says and elaborates:

"We know that oil has been down there, and the seal can thus hold. We also know how oil and water stream through the reservoir. That's how we also have a fair idea about how CO2 will act in the underground."

Norway already has two CCS projects at two old oil fields; Sleipner and Snøhvit, each of which can contain approximately 700,000 metric tons of CO2. Ineos estimates its project to hold a similar potential, perhaps slightly less.

"I would guess that we can deliver around a half million tons of CO2 per well, per year, so we should be able to store up to 1 million tons of CO2 per year with the two wells sketched at the Nini rig demonstration project.

DKK 1,200 per ton

If the Ineos-operated fields are to store the 3.5-4.5 million tons of CO2 per year that the DCCC intends, it will require each field to utilize both its wells. The actual potential of an individual field is estimated to be approximately 1 million tons per year.

Provided everything goes well, Ineos will expand the concept from Nini to several other fields before 2030.

First comes the pilot portion of the project, which will take place offshore and cost an estimated DKK 600 million.

If the concept is then to assume full scale in 2026, as planned, Ineos estimates capex investments worth DKK 2 billion and DKK 400 million in annual opex.

Expanding to several different areas toward 2030, the total investment will come to DKK 14 billion, according to the document sent from DTU to the energy committee.

But that disregards CO2 capture.

The Amager Resource Centre (ARC) has set an estimate pointing to a price between DKK 300 million and DKK 1 billion for establishing a plant able to capture roughly 450,000 tons of CO2, corresponding to all of ARC’s annual emissions. Operating such a plant is expected to cost DKK 650-950 per ton.

All in all, a value chain in which Ineos receives ARC’s CO2 and stores it in the North Sea will cost nearly DKK 1,200 per ton, the document shows.

But from 2028 to 2030, the price is expected to drop by approximately 35 percent to DKK 800 per ton.

This means that if the DCCC's recommendations for a CO2 tax of DKK 1,500 per ton ends up becoming reality, the concept could turn commercial in 2030, Svendsen says.

But financing of both the pilot and demonstration projects need to be secured, and that could take the form of EU subsidies.

Such aid would have to be applied for in early 2021. As such, a political strategy for CCS must fall into place this year if it’s to be doable, Ineos says.

Ineos is in talks with both ARC and Aalborg Portland on CCS. Currently, it’s mostly about exchanging experiences, Svendsen says.

If the Ineos concept is to be demonstrated around 2026, one of these actors could easily be included in a common solution, which the appended document sent to the energy committee shows.

Svendsen moreover says Ineos is in talks with owners of other CCS projects in Europe on acting as backup for one another.

Won’t be used for more oil

According to DTU, EU aid worth about DKK 800 million per year is needed for everything to come together. Initially, however, Ineos has only requested support for the project’s proof-of-concept phase. That application was filed last Friday, Svendsen says.

Now that you’re rolling out this large-scale CCS concept, is it also about being able to extract more oil by pumping CO2 into the underground?

"I can tell you with certainty that at fields where we consider storing CO2, we won’t be doing enhanced oil recovery [using CO2 as part of extraction efforts, -ed.]. I’m very sure about that. Nothing in our assessment is based on us extracting more oil from a field we’re pumping CO2 into," Svendsen says.

"We will, prior to CO2 storage, permanently close the production wells," he guarantees.

Now, the first thing for Ineos to do is test the material that the company drilled out of the underground. Lab studies will investigate things like how rocks react when subjected to CO2 below temperatures like those found beneath Nini, Nini East, Siri and Cecilie.

Those efforts are expected to take about one and a half year.

English Edit: Daniel Frank Christensen & Jonas Sahl Jørgensen

Oil giants aim for the stars with carbon well in North Sea

Occidental to stash CO2 at cement plant

Three oil giants want to save climate with hole in North Sea

Related articles

Oil giants aim for the stars with carbon well in North Sea

For subscribers

Occidental to stash CO2 at cement plant

For subscribers

Three oil giants want to save climate with hole in North Sea

For subscribers

.jpg)

.jpg&w=384&q=75)