Europe gas jumps as latest Russian cut plan stokes supply fears

European gas prices surged after Moscow’s move to shut a major pipeline ramped up fears of a prolonged supply halt, leaving Germany once again guessing as to how much Russian fuel it can count on this winter.

Benchmark futures rose as much as 16%, also driving up electricity prices to fresh records. The key Nord Stream pipeline will stop for three days of maintenance on Aug. 31, again raising concerns that the link won’t return to service as planned after the works. Europe has been on tenterhooks about shipments through the link for weeks, with flows resuming only at very low levels after it was shut for works last month.

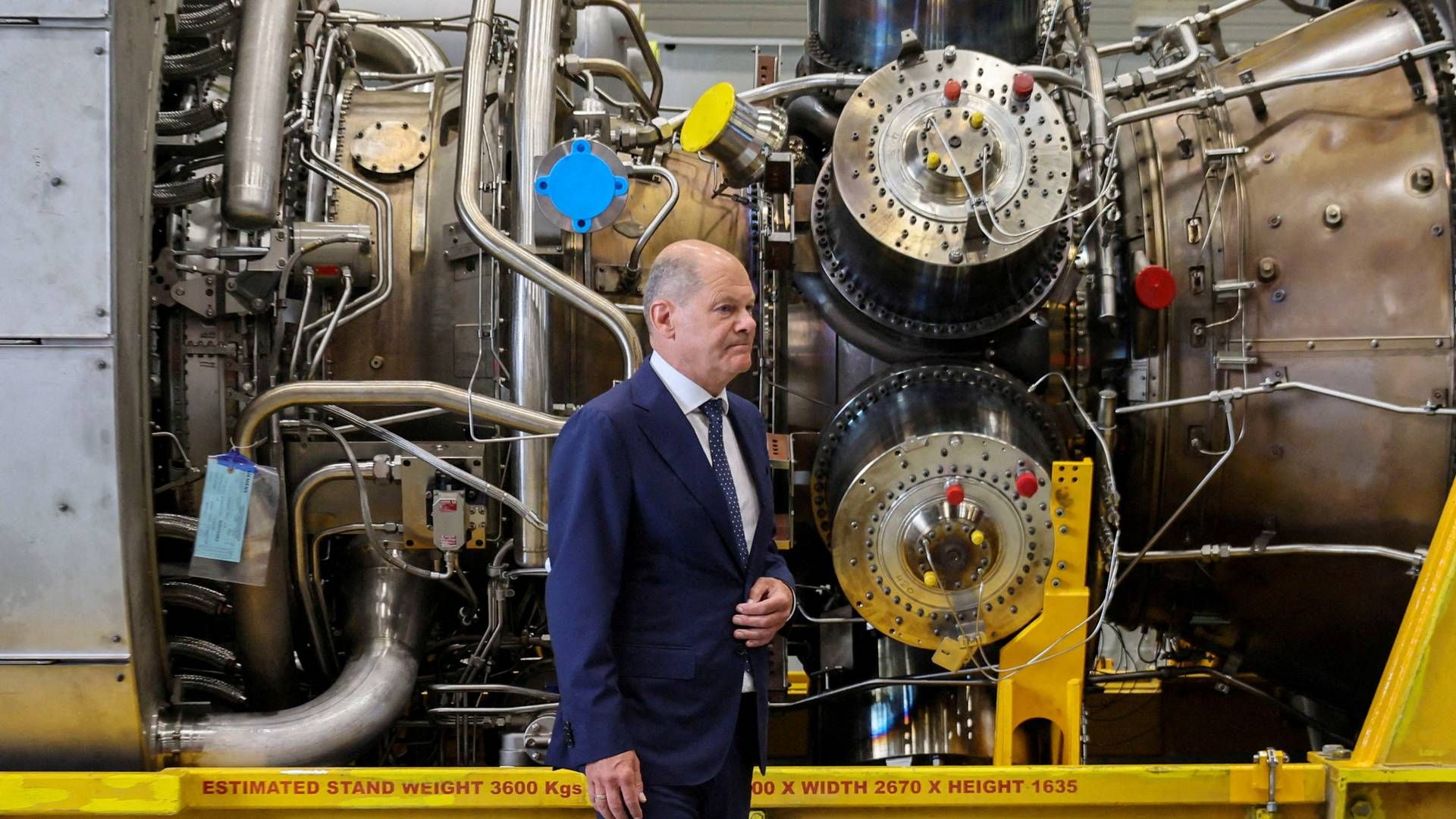

Germany warned Moscow could further reduce supplies, and reiterated a call for conserve energy. “We have a very critical winter right in front of us,” German Economy Minister Robert Habeck told public broadcaster ZDF in Montreal, during a visit to Canada with Chancellor Olaf Scholz. “We must expect Putin to further reduce gas.”

European authorities have repeatedly warned of the possibility of a complete shut down of Russian supplies as the Kremlin retaliates for sanctions imposed because of its war in Ukraine. Germany, Europe’s biggest gas consumer, is looking for alternatives but is unlikely to be able to replace all Russian imports. The nation and others in the continent are reversing energy policies by relying more heavily on coal and bringing back nuclear plants as they look to avoid shortages.

Politically motivated reduction

On Friday, Gazprom said works are needed in the only functioning turbine that can pump gas into the link. The pipeline has been operating at only 20% capacity for weeks and European politicians insist the curbs are politically motivated. Russia’s Gazprom PJSC said volumes would return to that level following the latest shutdown.

“Whether the reasoning is true or not, the outcome drives a European gas market that tightens further, and one that is left reliant on demand curtailments to find itself in balance,” said Biraj Borkhataria, an analyst at RBC Capital Markets. “The market may disregard Gazprom’s comments and start to consider whether the pipeline may not return to service, or at the very least may be delayed for any given reason.”

The Dutch front-month contract, the European benchmark, rose 15% to EUR 281.86 per MWh at 10:02 a.m. in Amsterdam. It rose for a fifth straight week on Friday, the longest run this year. The UK equivalent surged 16% on Monday.

German year-ahead power, a benchmark for the continent, rose as much as 13% to a record EUR 630 per MWh. The electricity market’s tightness was compounded by French nuclear reactor availability at near the lowest in years.

Over the weekend, German leaders said the country may struggle to replace dwindling gas supplies from Russia. The government is targeting a 20% reduction in gas consumption. While the country is one of the worst hit by Moscow’s cuts with the economy on the bring of a recession, the energy crisis has reverberated through Europe.

Analyst projects Nord Stream 1 doubling export volume this winter

German gas stockpiles being filled ahead of schedule

German chancellor blames Russia for gas turbine fiasco

.jpg&w=384&q=75)