NKT believes big projects lie ahead

Throughout the first half of 2018, NKT did not see big orders for the company's high voltage cables. It was not until July, when Ørsted issued an order worth over DKK one billion to supply half of the cables to the upcoming offshore wind farm Hornsea 2.

However, the slow first half of 2018 is not necessarily an indicator of the rest of the year, says Michael Hedegaard Lyng, CEO of NKT.

"Our employees in the sales and tender departments are very busy. We expect several large tenders soon and we are in a very good position to win one or more of the tenders. We ideally want to win orders in the size of EUR 100 - 150 million once or twice per year, and with Hornsea 2 we have also cemented our position as a leader within offshore wind," says Hedegaard Lyng.

The contract for Hornsea 2, published July 3, is valued at over EUR 145 million.

According to Hedegaard Lyng, several other large projects can soon be expected to be sent to tender in Europe.

"On the home market in Denmark, we have Viking Link, which was postponed earlier this year, but the process has now been resumed, and the project is unchanged. We hope it will be tendered out rather soon. Besides this, we are looking at Germany where several interconnectors are in the process and will go from a pre-tender phase to a more active phase."

In Q2 2018, NKT booked EUR 306.4 million in revenue, corresponding to 12 percent organic growth. This is to be compared with EUR 288.1 million in the second quarter of 2017. A development that NKT has called satisfying and which followed a boost in revenue across all business divisions.

However, while revenue is performing well, earnings have been challenged. EBITDA landed at EUR 31.1 million in the second quarter of 2018. This was a decline from EUR 10.8 million compared with the second quarter of 2017, but a EUR 11.7 million boost relative to the first quarter of 2018.

The challenge for earnings is particularly attributed to the fact that NKT is in the process of transforming its organization.

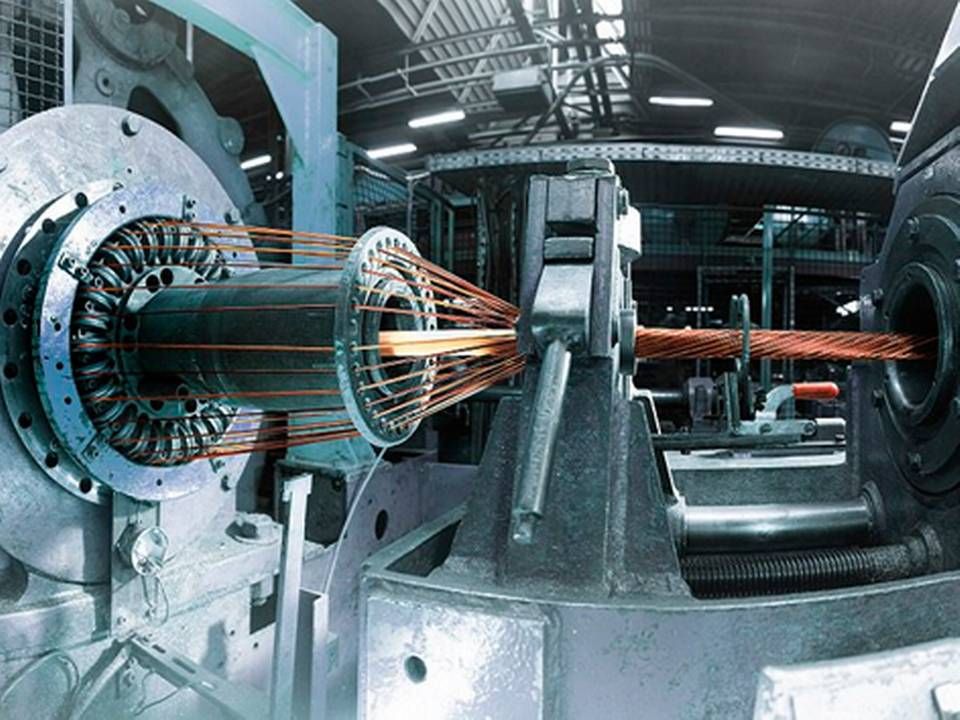

"Within our production of medium and low voltage cables, meaning typical cables for construction, we are amidst a transition from land-based entities to a more functional distrbution. This will give better margins, but the process has also proved more complex than first assumed and will take longer than just one single quarter," says Hedegaard Lyng.

Taiwan will be serviced from US and Europe

NKT's share price has experienced a turbulent period since its spin off from Nilfisk almost one year ago, resulting in a sharp price drive. Should NKT succeed in wining large projects in the fall, Hedegaard Lyng hopes the shares will better stabilize.

Another factor which could help NKT along would be the possibility of the company receiving offshore wind orders from new markets as developers such as Ørsted and Copenhagen Infrastructure Partnerrs (CIP) make their foray into countries such as Taiwan and the US.

"As Ørsted and CIP have said, they hope to use known suppliers on the upcoming projects in Taiwan and the US. We are certainly interested in both markets but have no plans to construct facilities in order to win orders," says Hedegaard Lyng, explaining that the market in Taiwan in particular is an interesting export case.

"The projects in Taiwan are located 20 - 30 kilometers from the coast, which is much closer than the 100 + kilometers that we know from Europe. Therefore, it would be possible for us to produce cables at our European factories and send them out on our vessel Victoria. An investment of EUR 150 million in a facility will not make sense in Taiwan.

The US can use the same model, in any case for the first projects, says Hedegaard Lyng.

"But the US is an exciting market not only due to blossoming offshore wind, but also because a range of interconnectors are being planned, for which there are no facilities in the US," he says.

English Edit: Lena Rutkowski

Related articles

NKT shows solid growth – but earns less

For subscribers

Prysmian awarded large cable order from Ørsted

For subscribers

.jpg&w=384&q=75)