Breakthrough optimism for Europe's next big offshore wind market

WARSAW

There's no doubt that the conference's guest of honor was Polish Minister of Energy Krzysztof Tchórzewski.

It's possible he might not go down in history for his unwavering support of wind energy. Quite the contrary – following the general election four years back, Tchórzewski's national-conservative government gutted the country's large onshore wind market by implementing large distance requirements, quadrupling property taxes for wind turbines and proposing prison sentences for turbine owners that repaired their equipment without first securing government approval.

But that was then.

Well, sort of. The problematic distance requirement is still in place, but turbine owners did escape prison sentences, and taxes have since been reduced. Meanwhile and perhaps equal importance, there are signs that Poland will be opening up to offshore wind, which was the theme of the conference held by the Polish Wind Energy Association (PWEA) and at which Tchórzewski appeared as a guest.

"For the first time ever, we have the honor of bidding an energy minister welcome. This is a very friendly gift to us on our 20-year anniversary as an industry," said Janusz Gajowiecki, PWEA's president, in a warm introduction.

Inheritance from Stalin

The minister did not, however, return the gesture with any intricately-curated politesse. As the first point in his speech, he relayed that he would not participate as planned in the subsequent panel discussion, as he felt himself obliged to prioritize the coming general election. Meanwhile – and unlike the three foreign ambassadors present on the list of speakers – he did not mention climate change or related issues.

Instead, he spoke about the EU requirements and Poland's historical subjugation to external powers.

"The Soviet Union left us with 99.5 percent coal-fired electricity, and the West doesn't accept that we lag behind the rest of Europe. It was easier for the East Germans, who had a rich brother, while Lithuania, Slovakia and Hungary got nuclear plants from the Soviets. Stalin saw the Polish resistance and instead gave us the Palace of Culture and Science," Tchórzewski said in reference to the building in central Warsaw, tall as a wind turbine, and which nationalists view as an unwanted monument of the past.

"That's where our deliberations on the energy sector began. If we are going to open up to other energy sources, we'll need to know how much to invest and how much conventional [generation, -ed.] we may use. One must be rich to use renewable energy."

Inserted in the tale of Polish resistance was another point: That Poles are highly opposed to the expansion of onshore wind. Before the government's termination program began, the country's onshore wind market was Europe's second-largest. Moreover, Tchórzewski explained that the reason the runway leading to offshore wind's Polish takeoff has been so long is due to the political will to avoid similar situation in the future.

"In the rapid expansion of onshore wind, the feelings of local communities were ignored, which led to local resistance. Looking at certain areas in Poland, there are around 100,000 established anti-wind associations," Tchórzewski noted.

"We were in the opposition at the time, so we couldn't have done anything. But we supported those citizens. That doesn't mean we turned our back on offshore wind, which has seemed an obvious choice from the beginning. But now that we have introduced order, everyone knows what to expect. This also means that even the greatest enemies of renewable energy must accept the direction. But some things take time; nothing is for free, and we have to do everything ourselves," he continued.

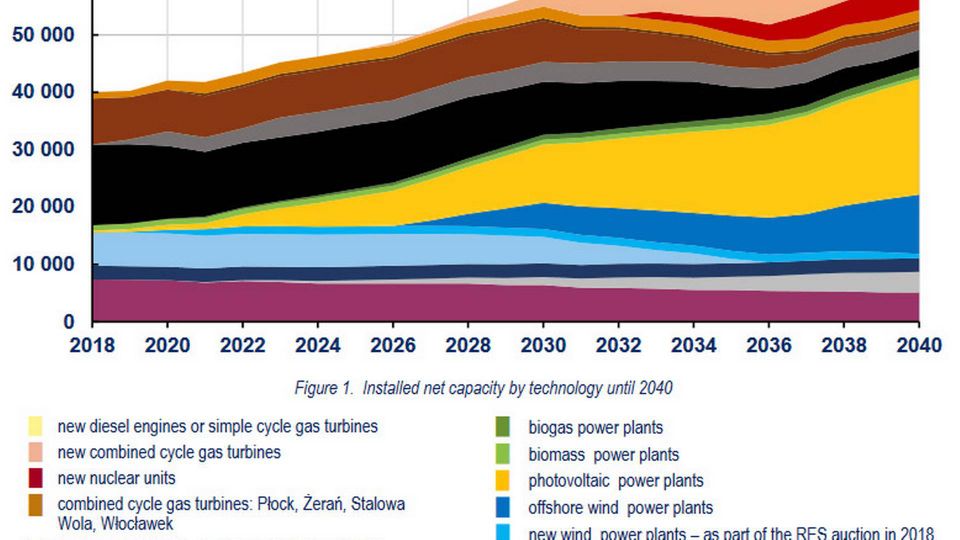

Thus far, Warsaw has submitted a proposal to the EU, entailing the installation of 10.4 GW by 2040. The EU's acceptance from earlier this year of Poland's wish to subsidize its coal power plants with EUR 5 billion up to 2029 has, according to Tchórzewski, given the government the needed calm to focus on the transforming the proposal into an actual expansive project.

"We know how the process will be, and we have prepared quite a lot. Some things are missing, but not much," the minister stated before departing for the election campaign that's running until the election next Sunday.

Law to follow election

At first glance, though, Tchórzewski doesn't immediately appear to have been forced to tour the country. The governing Law and Justice Party (Prawo i Sprawiedliwość) not only stands to be reelected; the latest polls predict the opposition's decimation and project that PiS will surge from 37.6 percent from four years back to around 45 percent of the vote.

Even though in Western Europe, PiS has an infamous status of Europe's sluggish, coal-crazed climate antagonist, the mood at the conference was widely optimistic. The Polish wind industry is highly confident that action will follow after all votes are counted – even if the government hasn't transformed itself into green idealists by that time.

"We know that legislation is almost settled, and I believe it will be made public within a month or two and enter force at the beginning of the new year," PWEA President Gajowiecki tells EnergyWatch.

A fresh breeze

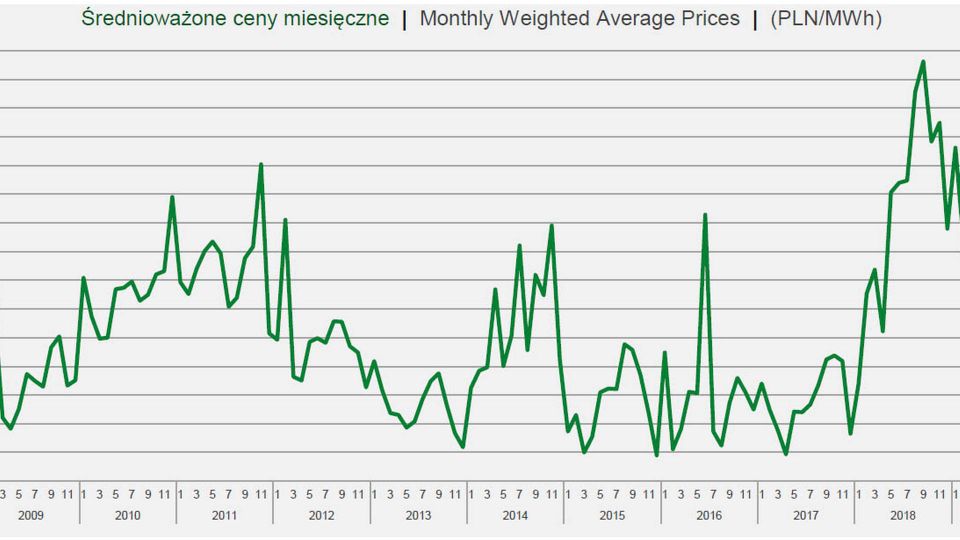

The optimism is not so much based on the EU climate targets, but more on another instrument from Brussels – the CO2 quota system. The last two years of rising carbon costs have pressured Poland's coal-fired electricity prices so far up that Warsaw has had to intervene with an aid package worth EUR 417 million for the country's energy-intensive companies, a move that the EU approved in the acknowledgment that the factories might otherwise be forced out of the union.

That solution will not continue to enjoy the EU's support for long, however. At the same time, two other aspects underline an increased need. In part, 4 percent annual growth in expected up to 2025, which will boost energy demand even further. Secondly, Poland expects, according to the aforementioned drafted proposal, to decommission around 16.7 GW of coal capacity before 2035. The country's planned nuclear plants are expected to go online toward the end of that period.

"Poland's energy system needs a fresh breeze that only offshore wind can deliver so quickly and at the required scale. We don't think that government's proposed 10 GW will be enough; the Baltic Sea has the potential for 20-30 GW, but this is an adequate beginning. So, we'll install that first 5-6 GW up to 2030, and then we'll see what happens," Gajowiecki says.

Oil firm enters offshore wind

The 5-6 GW of offshore wind are already approaching the finish line. Polenergia and Equinor have received a license for project Baltyk I of 1,560 MW, and utility PGE has achieved the same in the development of Baltica 2 and 3 of a combined 2,545 MW, while oil company PKN Orlen is developing a 1,200MW project through its subsidiary Baltic Power.

“We were considering offshore wind as early as 2011-‘12, but it was too expensive at the time. However, with the rapid progress we’re now seeing in the sector, the time is right to enter the market. It will contribute to one of the solutions the EU Commission demands from Poland regarding emissions,” says Baltic Power CEO Krzysztof Kidawa, who concedes, however, that the oil company does not entirely act out of climate interests.

“We only enter business if we know it’s profitable. The combination of CO2 prices, declining costs for offshore wind and wind speeds off Poland’s coast convinces us that it’ll be good business.”

He, too, is waiting to see the government’s targets turned into legislation, and how the expansion will occur in practice. PKN Orlen itself recommends a model like the UK’s, which operates with Contracts for Difference guaranteeing project owners fixed account settling, regardless of power price fluctuations.

Polish authorities have already made moves to draw inspiration from the UK on another matter. Thus, developers themselves will handle the financing of connecting offshore wind farms to the grid.

EU must co-finance grid

This connection, meanwhile, is not the only thing needed. The transmission grid on shore must also see some significant improvements if a large amount of power is to be generated by offshore wind farms off the northern coast. Aside from grid reinforcement in the north, this will require new lines toward the south, where both coal districts and the heavy industry reside in regions like Silesia.

Implementing 10 GW of offshore wind would take investments of about EUR 3 billion in suspended transmission over the coming ten years, Eryk Klossowski, CEO of Polish transmission system operator PSE, tells EnergyWatch. However, he doesn’t think Poland should be the only one paying the bill.

“I think the EU Commission should partake in the investment plan,” Klossowski says, adding it no longer makes sense to talk about national transmission in the EU after the implementation of the latest energy package. Besides requirements for RE expansion and energy efficiency, this also demands member states open their supplies to neighboring countries.

“When at least 70 percent of transmission capacity must be open to international trade, we should stop distinguishing between Transeuropean and domestic cable lines. Nothing in the high voltage grid belongs solely to domestic markets anymore.”

Requires connectors to Sweden and Denmark

Concerning Poland’s connections to the east, the country has synchronized Lithuania with the EU grid. Moreover, in its grid expansion plan looking to 2025 it still has a number of 400kV projects on the union’s list of projects of common interest. However, this plan assumes only 5 GW of renewable energy. To establish 10 GW, more overseas connections are needed than the single one to Sweden that Poland has had since 2000.

“Another connection to Sweden will be needed, and we will need the first interconnector to Denmark,” Klossowski states, saying these are preconditions for offshore wind expansion to exceed 4 GW.

“I think so, because the project’s financial burden is huge. But as revealed by the analyses from Entso-E, the business plan to realize and implement both connections across the Baltic is strong.”

According to preliminary analyses, the contemplated 600MW connection between Dunowo, Poland, and Avedøre, Denmark, will also provide a socioeconomic profit, if modest. Mainly because it’s estimated to reduce carbon emissions by more than twice the amount reduced by the British-Danish Viking Link. The interconnector, set to be installed toward 2033, does not yet figure in Danish TSO Energinet’s expansion plan.

NIMBY and CAVE

However, the CEO doesn’t think the grid expansion in itself is the main problem, just as he doesn’t doubt that offshore wind will be established in Poland. Rather, according to him, the big question is how quickly it will happen. A question that’s highly dependent on whether there is a solution to the underlying theme for the conference’s guest of honor.

“The Polish grid is a challenge, just like everywhere else in Europe. The biggest challenge is the sentiment in our society as expressed by NIMBY [not in my back yard, -ed.] and CAVE [citizens against virtually everything, -ed.]. The consequence of this is that projects become slower and slower. Nonetheless, I think we’ll be ready to deliver the grid within the coming decade,” Klossowski says.

English Edit: Daniel Frank Christensen & Jonas Sahl Jørgensen

Siemens Gamesa wins largest Arctic order

Polish energy players form offshore wind partnership

Macquarie-owned infrastructure investor buys first Polish wind market morsel

Related articles

Siemens Gamesa wins largest Arctic order

For subscribers

Polish energy players form offshore wind partnership

For subscribers