IEA: Offshore wind could become Europe's largest power source from 2050

A simultaneous sigh erupted from the seats of the Frederiksberg Town Hall as the International Energy Agency (IEA) presented its new report, Offshore Wind Outlook 2019. Well now, the sigh could be called a modern exaltation and one not so much characterized by shortness of breath but rather with a scene of of everyone gripping their smart phones to immortalize the moment through photo documentation. Yet still.

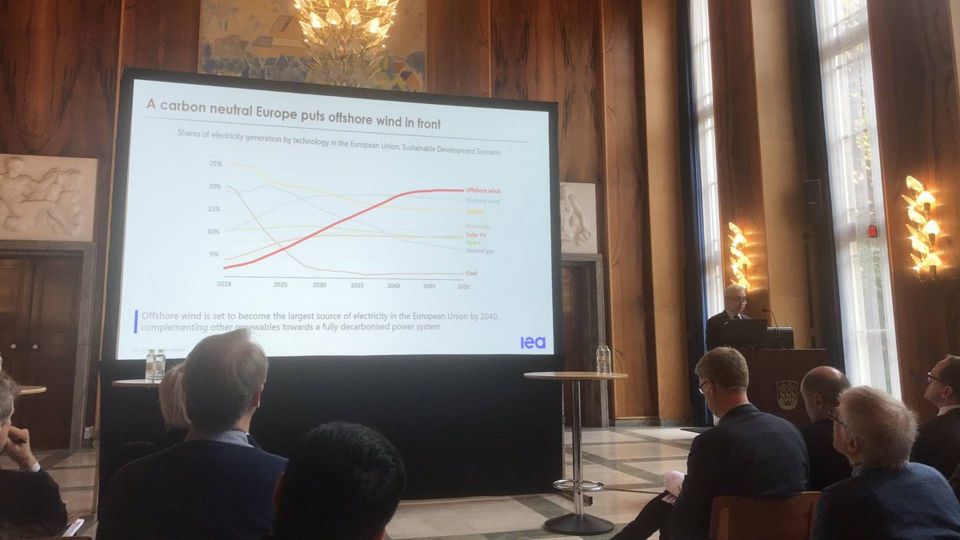

The photogenic slide below showed IEA's prognosis that, from 2050, offshore wind could become Europe's largest source of electricity. Indeed, a close reading of the graph would rather indicate that offshore wind will overtake onshore wind by 2040 and become supplier par excellence to the continent's power grids – that is, if one opts to take the Sustainable Development scenario at face value.

In reality, that very slide was the only one of its kind omitted from the IEA's first-ever offshore wind report, which saw its world premiere last Friday in Denmark. The report's conclusions on the one hand pointed to the practically limitless potential of offshore wind and, on the other hand, the expectation that ratified global policies will result in 317 GW of installed offshore capacity in 2040 with prices of USD 45 per MWh.

Those sorts of conclusions don't exactly cause the same degree of sighing in a conference hall filled up with industry players. In the best of cases, it's a completely familiar syllabus. In reality, it's rather a somewhat unambitious outlook in terms of capacity, regarding which the EU Commission has mentioned a total volume of 450 GW installed in the union alone from 2050. In terms of prices, the latest UK auction resulted in rates as low as GBP 39.65 per MWh for projects installed around 2025.

Global reference manual

However, it wasn't so much the report's specific content that made the industry receive the report with glee. Rather, it's due to the fact that the monstrously influential energy agency has officially given its first-ever blessing to offshore wind.

Siemens Gamesa Renewable Energy Offshore Business Unit Head of Offshore Technology Morten Pilgaard Rasmussen is of the same opinion.

"I believe the whole industry is very well pleased with this. That it in many ways describes what we have known for a long time in Northern Europe doesn't actually make much difference, but it will for the rest for the world that read this report. It will become a reference manual for decision makers around the whole world," Rasmussen explains.

The chicken and the egg

That Denmark was selected to host the report's presentation might seem somewhat curious in this context. The pronounced difference between the reports' significance for the industry and its relative triviality was also tangible during the event. As is often the case at such stately occasions, the many distinguished, ceremonial figures were barely able to refer to the seminal status of the event before again evaporating.

However, for the persistent and accommodating, a single element did present itself as cause for further discussion. The most frequently voiced critique of the IEA is that it seems more apt to make predictions about the future of oil and gas – which was the agency's baptismal raison d'être in the 1970s – rather than forecasting anything precise about renewables. This is most evident when the agency makes its annual underestimation for forward-looking solar power expansion.

In the same ballpark, a few jabs were also thrown at the IEA for its conservative price projection for future offshore wind. A reduction of 40 percent over a 20-year period using USD 100 per MWh as a benchmark is well on the conservative side of things, as seemed to be the sector's consensus.

"I am on board about the report needing to show a realistic goal that is supported by what is visible for the IEA. But I think the industry could [beneficially, -ed.] operate with slightly sharper targets," Rasmussen says, adding:

"It's a very fine balance. Because we need to know what the realistic potential is but at the same time also assert that this will require volume and scale to make it that far."

Will the IEA pull an Ørsted?

For the same reason, some of the things the industry appreciates the most about the report are the potential pitfalls it presents: that it won’t do any good building offshore wind farms if there are no parallel investments in transmission; that specified sea space for offshore wind needs to be planned; and that there is need for long-term, political frameworks for the technology to realize its potential.

“Taking Germany as an example, they’ve limited their considerable potential due to transmission bottlenecks. So even though national governments no longer need worry that much about consequences for the state budget if they allocate another 5-6 GW of offshore wind, they remain important in establishing frameworks,” asserts Neubert.

The report’s section on expected price developments isn’t among his favorite pages, either. Especially not the part which states that, while European and Chinese offshore wind will be able to compete with gas and coal by 2030, developments in the US – where Ørsted is betting big – see recent project proposals indicating that offshore wind will soon be a viable venture on the east coast.

“If there’s one place in the report where I’m not convinced the IEA has entirely grasped the potential, it’s definitely in pricing,” says the offshore wind chief diplomatically, quickly turning his gaze inward and avoiding the question of Ørsted’s historical price predictions.

“In 2012, our 2020 target was a price of EUR 100 per MWh, and fortunately we were gravely mistaken. Moreover, I understand that when talking about price developments, bases and points of reference are always up for discussion, but compared to 2012, the prices in the most recent British auction was actually 70 percent lower. So in terms of costs, there is something for them to keep working on for the next iteration of the report.”

English Edit: Daniel Frank Christensen & Jonas Sahl Jørgensen

IEA puts offshore wind center stage

New EU directive adds big energy savings

IEA: Doubling renewable capacity insufficient to hit climate targets

.jpg&w=384&q=75)