Sanctions against Russia and rising inventories shake up oil prices

Oil prices teeter between rising and falling Wednesday morning due to a strengthened US dollar, further sanctions against Russia as well as US crude stockpiles being replenished.

A barrel of European reference oil Brent trades Wednesday morning for USD 106.76 against USD 106.79 Tuesday afternoon. US counterpart West Texas Intermediate sells at the same time for USD 101.8 against 102.37.

“Higher dollar, an increase in US crude stockpile and concerns over weaker demand in China due to Shanghai’s continued lockdown added to pressure in early trade,” says Hiroyuki Kikukawa, general manager of research at Nissan Securities, to Reuters.

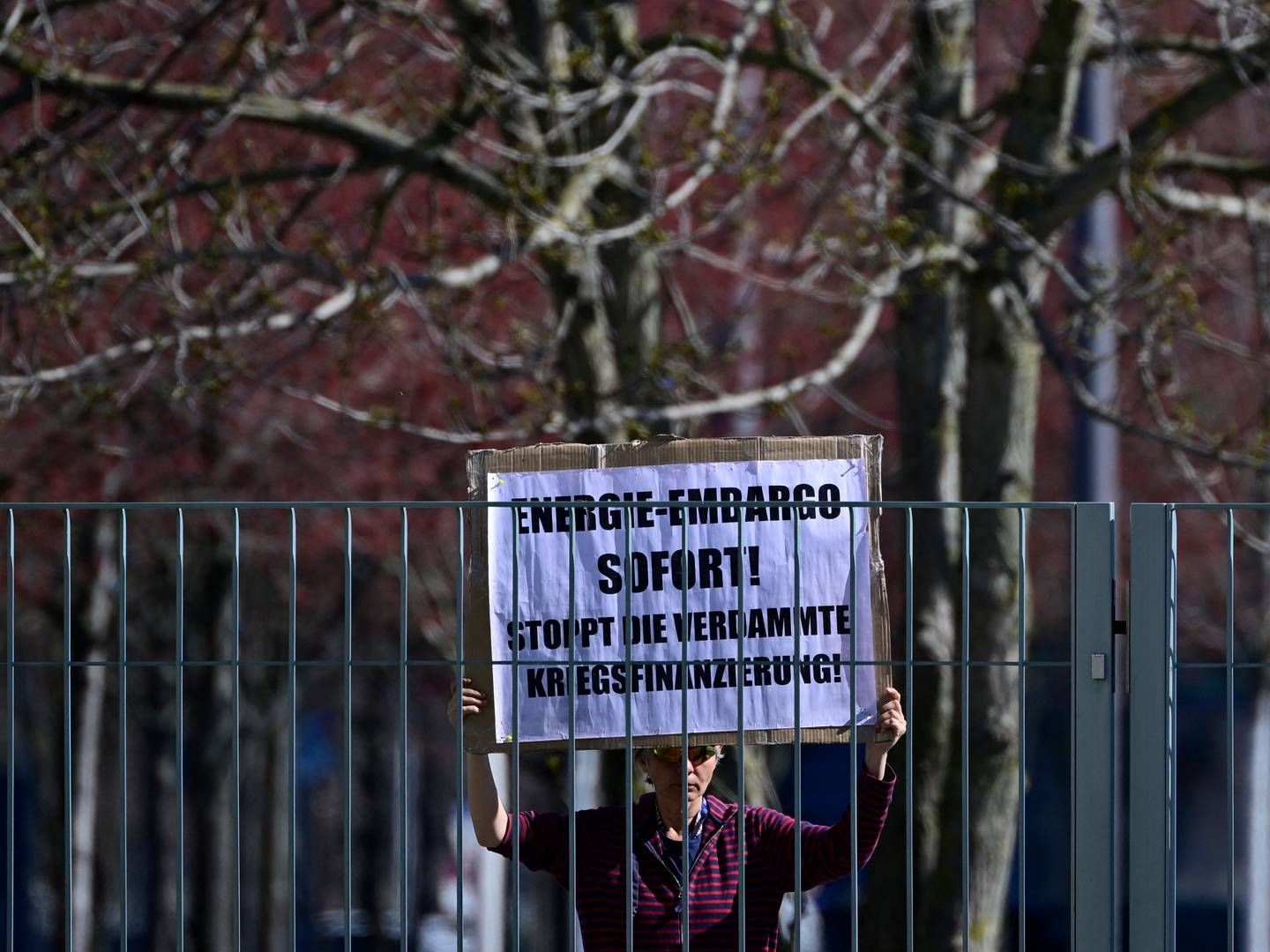

Over the last few hours, oil prices have surged because the US, UK and EU are planning new sanctions against Russia. Proposed EU sanctions entail banning purchases of Russian coal as well as forbidding the Russian ships from calling at EU ports. Oil is also being discussed.

The UK is urging G7 counties and NATO to reach an agreement on a time table for discontinuing imports of Russian oil and gas.

After several hawkish comments from regional US Federal Reserve chiefs, the dollar gains strength Wednesday morning, meaning that, all other factors held constant, crude is more expensive to buy for holders of currencies other than the US dollar.

The latest figures from the American Petroleum Institute (API) show US oil inventories rising with 1.1 million barrels last week – more than economists had forecast. According to the news agency, the consensus estimate foresaw a fall of 2.1 million barrels.

Russian Ambassador to Denmark: If Ørsted doesn’t pay in rubles, gas could get cut off

EU to propose ban on imports of Russian coal

Oil trades higher in wake of Russian war crimes

UN report pushes climate targets out of reach

.jpg&w=384&q=75)