Big turbine blade maker counts on Coronavirus impact this year

TPI Composites has to deal with plenty of obstacles during 2019. Among other issues, workers went on strike at the company's new factory in Mexico, and the collapse of its big customer Senvion also merited downgrades during the period. Now, one month past the fiscal year's final day, the OEM again has cause to lower expectations.

In a presentation of the preliminary annual results, sales are adjusted to USD 1.42-1.44 billion against the prior spread of USD 1.45-1.5 billion. The company's original guidance was set to USD 1.6 billion.

The update is even more remarkable concerning the operating result. Even though investors have long resigned themselves to the year ending in deficit, expectations are now being cut even further relative to the latest downgrade in November. TPI now estimates a loss of USD 15-16.5 million – more or less twice that of the year prior.

Forecasts progress in 2020

Operating income wasn't the only item to have stricken the blade maker, which established a great deal of new production capacity last year. The outlook for adjusted earnings before interest, taxes, depreciations and amortizations is maintained at the hitherto range of USD 80-85 million. Unlike previous downgrades, the new figures aren't hurting TPI on the stock exchange – quite the contrary, the share price was up 5.5 percent after Friday's announcement.

The complete annual financial statement is set for release on Feb. 27.

However, the 2020 forecast was published Friday and predicts a rebound of black bottom-line figures, projecting a net result of USD 16-26 million and growth of both sales, USD 1.55-1.65 billion, and EBITDA in the interval of USD 140,000-145,000.

Unknown Coronavirus consequence

Just as TPI had a lot on its plate in 2019, the same thing could prove true of this year. With two factories and thereby a large part of its production located in China, the manufacturer acknowledges not being immune to the effects of the Coronavirus.

"Our guidance for 2020 excludes the potential impact of the Coronavirus, which we expect will negatively affect our results of operations for 2020," writes TPI, which finds itself unable to "reasonably estimate the overall impact to our operations given the fluidity of the situation at this time".

"As a result of the Coronavirus quarantine and movement restrictions being imposed in China, we currently expect that most of our Chinese associates will return to our Chinese manufacturing facilities in late February and our production of our wind blades will restart in early March," the company adds.

TPI writes that, as soon as circumstances surrounding the outbreak have stabilized, it will update its 2020 guidance and provide an estimate on whether it will be possible to compensate for "a portion of the projected lost volume later" in the year.

The blade producer supplies components to all of the major western wind OEMs. The largest customer by far, though, is Vestas, whose requirements fully occupy slightly more than 50 production lines. For instance, a multiple-year contract with the Danish wind turbine manufacturer led to TPI opening its factory in Yangzhou, China, last year. Another quarter goes to GE, while Nordex, Siemens Gamesa and Enercon buy a smaller portion.

English Edit: Daniel Frank Christensen

Vestas to build zero-waste turbines from 2040

Vestas fires staff in Denmark and Germany

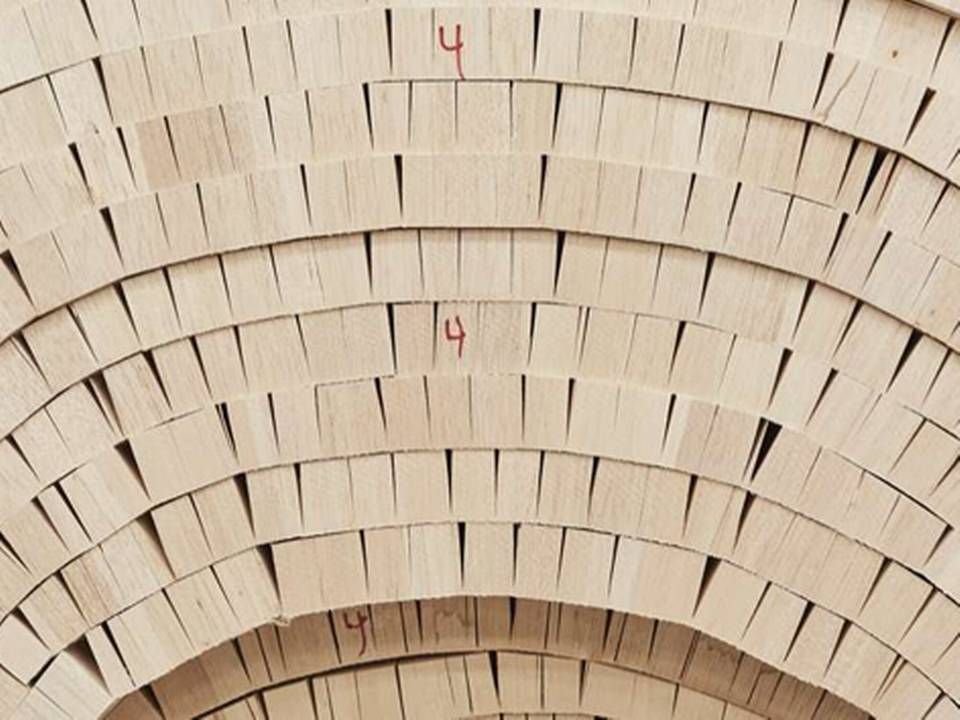

Great year for wind industry hit by scarcity of core product

Related articles

Vestas to build zero-waste turbines from 2040

For subscribers

Vestas fires staff in Denmark and Germany

For subscribers

Great year for wind industry hit by scarcity of core product

For subscribers

.jpg&w=384&q=75)